Debt settlement can work, but it carries significant risks. It can negatively impact your credit score, potentially by hundreds of points, making future borrowing more difficult and expensive.

Debt settlement can work, but it carries significant risks. It can negatively impact your credit score, potentially by hundreds of points, making future borrowing more difficult and expensive.

Anyone who is deeply in debt has likely considered debt settlement as a way of achieving debt relief. But does debt settlement work in reality? What are the pros and cons, and how does it compare to the alternatives?

Here’s a brief primer on “Does debt settlement work?” that answers these questions and others.

How Does Debt Settlement Work?

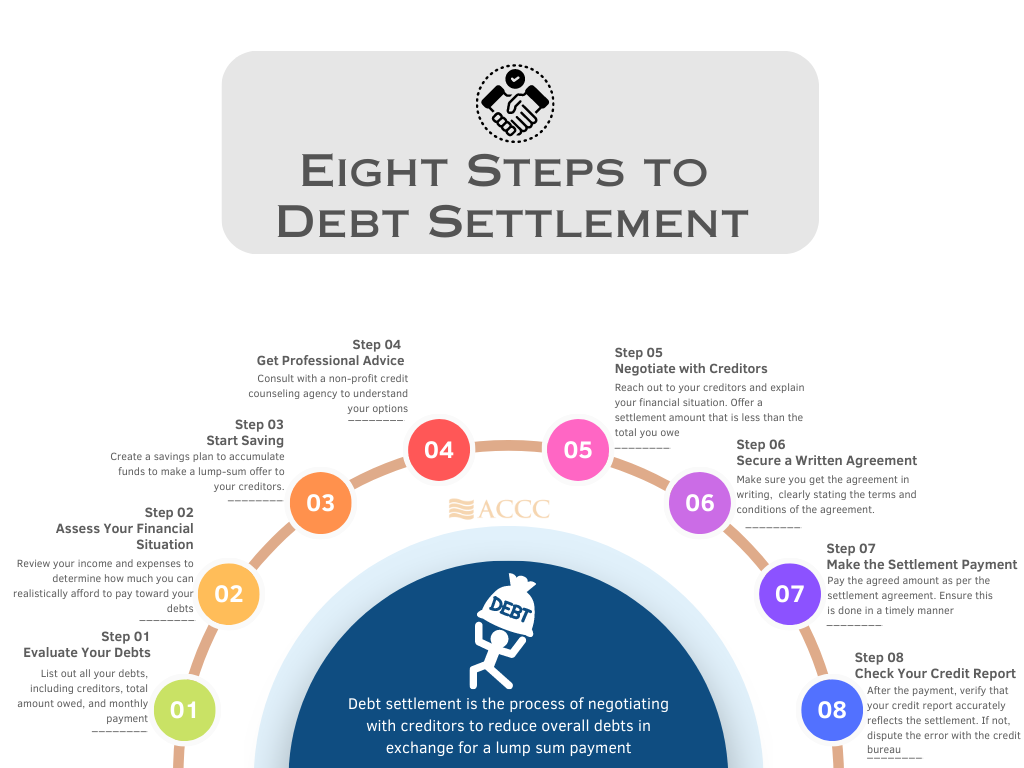

With a debt settlement program, you stop paying your bills until your overdue balances have become worrisome for your creditors. At that point, you offer to settle your debt for a lump sum payment that is typically anywhere from 25% to 80% of what you owe.

The debt settlement process – The debt settlement process is complex and must always be carefully evaluated every step of the way.

How Effective is Debt Settlement?

1. Erasing Debt

In a word: sometimes. Sometimes creditors will accept your debt settlement offer, fearing that it’s the most they can get from you. Sometimes creditors will decline your offer, perhaps taking you to court or turning your case over to collections.

2. Impact on Taxes and Fees?

If your creditors accept your settlement offer, you’ll likely have to pay taxes on the amount of money that is forgiven. If you use debt settlement companies, you’ll also have to pay their fee, which may be as high as 25% of the money you saved.

3. Impact on Credit Rating

Yes. Because you stopped paying your bills during the debt settlement process, your credit rating will take a severe and lasting hit. It may take as long as seven years to restore your credit, and in the meantime, you’ll have difficulty applying for loans, mortgages, credit cards, and even apartments.

Key Takeaways

-

Debt Settlement Outcomes Vary: Not all creditors may agree to a settlement, making outcomes unpredictable.

-

Credit Score Impact: Debt settlement can significantly damage your credit score, potentially taking up to seven years to recover.

-

Additional Costs: Debt settlements may lead to taxes on the forgiven amount and fees if using a debt settlement company.

-

Comparison with Bankruptcy: Bankruptcy’s impact on credit ratings is often more prolonged than debt settlement.

-

Comparison with Other Strategies: Both debt consolidation and debt management may be slower in reducing debt but tend to be less damaging to your credit score compared to debt settlement.

4. Bankruptcy vs Debt Settlement

Many people are interested in the benefits of debt settlement vs bankruptcy. Bankruptcy is considered the last resort for dealing with debt, and it tends to take longer to overcome the impact of bankruptcy on credit rating than debt settlement.

5. Is Debt Consolidation a Better Alternative?

Debt consolidation is a strategy for reducing the interest rate on a loan by taking out a new loan at a lower interest rate. The important thing to keep in mind when considering debt consolidation vs debt settlement is that debt consolidation does not typically reduce or eliminate your debt as quickly as debt settlement potentially can, but it likely won’t have much of an impact on your credit rating.

6. Debt Management vs Debt Settlement

Debt management is a strategy that involves managing your finances more carefully to pay down your debt more quickly. A debt management plan may not retire your debt as quickly as a successful debt settlement arrangement, but it won’t have nearly the same adverse effect on your credit as debt settlement credit score impact.

Bottom Line

Whether you’re considering debt settlement, bankruptcy, debt consolidation, or debt management, it’s important to look at the pros and cons of each approach before you make a decision. American Consumer Credit Counseling (ACCC) offers free credit counseling sessions that can help you understand the benefits and drawbacks of each strategy and help you make the decision that is right for you.

Debt settlement can work, but it carries significant risks. It can negatively impact your credit score, potentially by hundreds of points, making future borrowing more difficult and expensive.

Debt settlement can work, but it carries significant risks. It can negatively impact your credit score, potentially by hundreds of points, making future borrowing more difficult and expensive.