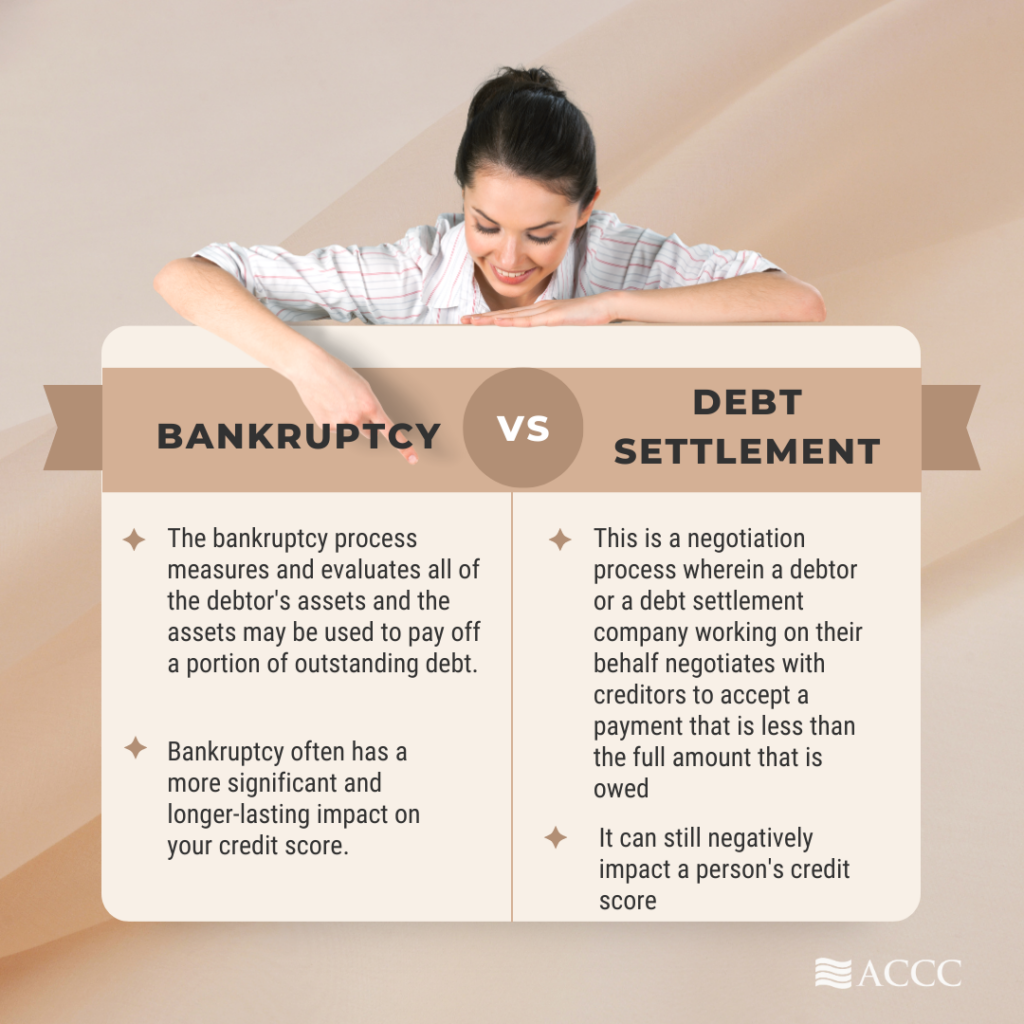

The main difference between bankruptcy and debt settlement lies in their approach to handling debt and the impact they have on your financials.

The main difference between bankruptcy and debt settlement lies in their approach to handling debt and the impact they have on your financials.

When you’re looking for the best way out of debt, it’s helpful to compare the pros and cons of bankruptcy vs settlement of debt.

What is debt settlement? When you seek to settle debts with your creditors, you’ll stop paying your bills for a period of time, putting money into a savings account instead. When your accounts are seriously overdue, you’ll make an offer to settle your debt with creditors for a lump sum payment that is less than the total of your actual debt.

When you file bankruptcy, you’ll enter a legally binding process that will eliminate your debts. However, you may lose some or all your assets, and your financial standing will be ruined.

One of the advantages of bankruptcy vs settlement is that it prevents your creditors from harassing you for money. In the debt settlement process, your creditors are not required to accept a debt settlement offer and may even take you to court, adding additional legal fees to your debt.

Does debt settlement affect your credit? Absolutely. It may take you years to rebuild enough credit to apply for loans, rent an apartment, afford a mortgage, or buy a car. Of course, when considering bankruptcy vs settlement, bankruptcy will affect your credit even more severely.

Additional considerations

-

- Bankruptcy will include legal fees, but they may be lower than the high service fees charged by a US debt settlement service.

- You may have to pay taxes on any debt that is forgiven in a settlement arrangement, while you will not pay taxes on debt erased through bankruptcy.

Debt Advice From ACCC

As you sort out the benefits of bankruptcy vs settlement, it’s helpful to get objective financial advice from a credit counselor like those at American Consumer Credit Counseling (ACCC). We are a nonprofit organization dedicated to providing free credit counseling and low-cost debt services that have helped thousands of individuals and families to find their way out of debt.

When you contact us for a free credit counseling session, our certified counselors can help you get a better picture of your financial situation as well as the options available to you for getting out of debt, including bankruptcy vs settlement, consolidation, and debt management. We can answer questions like, “Is debt settlement bad for my financial future?” and “How long will it take me to repair my credit after bankruptcy?” And we can direct you to social service referrals and to financial resources that can help you learn more about managing money.

Debt management As An Alternative

For consumers who want to avoid bankruptcy or debt settlement and bad credit, we often recommend debt management as a more advantageous alternative. With debt management, you’ll continue to pay your creditors while working with our team to stick to a budget you can live with. You’ll get the support you need to make payments on time each month, and the training and education to develop the skills you’ll need to stay out of debt in the future.

To learn more about debt management vs bankruptcy vs settlement, contact us today for a free credit counseling session.

Get Your Personal Debt Solution Plan The main difference between bankruptcy and debt settlement lies in their approach to handling debt and the impact they have on your financials

The main difference between bankruptcy and debt settlement lies in their approach to handling debt and the impact they have on your financials