Thirty-nine percent of consumers say greatest financial worry is credit card debt according to survey by American Consumer Credit Counseling.

Boston, MA – April 19, 2017

“Many consumers today are experiencing worry and stress associated with increased living expenses and stagnant wages – which can lead to excess credit card debt,” said Steve Trumble, President and CEO of American Consumer Credit Counseling, which is based in Newton, MA. “As a result, a significant portion of consumers are decreasing spending rather than putting money towards debt payments and retirement savings – keeping them from being able to feel a sense of financial security.”

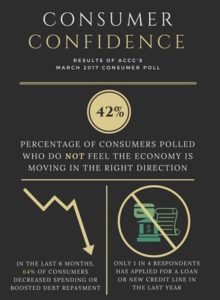

According to the survey, 36 percent of individuals believe the economy is moving in the right direction while 42 percent fear the opposite. Of the respondents, 25 percent have a combined income between $40,000 and $69,999, followed by 23 percent with an income between $20,000 and $39,999. A majority of the respondents say they haven’t opened any new lines of credit.

According to a recent Gallup survey, Americans’ financial worries have increased significantly from 2015 to 2016. The survey shows 60 percent of Americans are concerned about not being able to pay medical costs for a serious illness or accident, as opposed to 55 percent in the previous year. Additionally, in 2016, 51 percent feared they will not be able to maintain the standard of living they enjoy, up from 46 percent in 2015. The percentage of people that worry they will not have enough money to pay monthly bills rose from 36 percent in 2015 to 41 percent in 2016. Compounding the challenge is that 76 percent of Americans live paycheck to paycheck, according to a survey by The Simple Dollar.

The online poll of 250 consumers was conducted by American Consumer Credit Counseling on the organization’s website, www.consumercredit.com. You can view an infographic illustrating the poll results here: https://www.consumercredit.com/wp-content/uploads/2020/05/consumerconfidence_infographpdf.pdf

ACCC is a 501(c)3 organization that provides free credit counseling, bankruptcy counseling, and housing counseling to consumers nationwide in need of financial literacy education and money management. For more information, contact ACCC:

- For credit counseling, call 800-769-3571

- For bankruptcy counseling, call 866-826-6924

- For housing counseling, call 866-826-7180

- Or visit us online at https://www.consumercredit.com

About American Consumer Credit Counseling

American Consumer Credit Counseling (ACCC) is a nonprofit credit counseling 501(c)(3) organization dedicated to empowering consumers to achieve financial management through credit counseling, debt counseling, bankruptcy counseling, housing counseling, student loan counseling and financial education. Each month, ACCC invites consumers to participate in a poll focused on personal finance issues. The results are conveyed in the form of infographics that act as tools to educate the community on everyday consumer debt issues and problems. By learning more about financial management topics such as credit and debt management, consumers are empowered to make the best possible financial decisions to reach debt relief. As one of the nation’s leading providers of personal finance education and credit counseling services, ACCC’s certified credit advisors work with consumers to help determine the best possible debt solutions for them. ACCC holds an A+ rating with the Better Business Bureau and is a member of the National Foundation for Credit Counseling® (NFCC®). To participate in this month’s poll, visit ConsumerCredit.com and for more financial management resources visit https://www.consumercredit.com/debt-help/.