0 National nonprofit American Consumer Credit Counseling shares important facts on the advantages and the disadvantages to bankruptcy.

Boston, MA – September 26, 2016

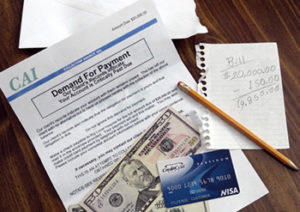

Bankruptcy is a proceeding in a federal court in which an insolvent debtor’s assets are liquidated and the debtor is relieved of further liability. There are two types of bankruptcy – Chapter 7 deals with liquidation, while Chapter 13 deals with reorganization.

“The decision about whether to file for bankruptcy can be incredibly difficult, and consumers should be aware of all the alternatives available when facing severe financial trouble,” said Steve Trumble, President and CEO of American Consumer Credit Counseling, which is based in Newton, MA. “It is important that consumers get advice about bankruptcy early and understand the process – including what it does and does not do – if they are considering bankruptcy to relieve themselves of certain debts.”

Medical expenses continue to be the leading cause of bankruptcy in the U.S. According to the United States Courts, bankruptcy filings fell 6.9 percent (819,159) in June 2016 compared to the number of filings in June 2015 (879,736). This number of bankruptcy filings has not been this low since December 2007.

In an effort to help educate consumers, American Consumer Credit Counseling provides consumers with information about the advantages and disadvantages of filing for bankruptcy.

Advantages of Bankruptcy:

- One of the most important advantages of filing for bankruptcy is that consumers can obtain a fresh financial start.

- If you are eligible for Chapter 7 most of your unsecured debts may be forgiven or discharged. A secured debt is one which the creditor is entitled to collect by seizing and selling certain assets if payments are missed, such as a home mortgage or car loan.

- You may be able to keep (that is, exempt) many of your assets, although state laws vary widely in defining which assets you may keep.

- Collection efforts must stop as soon as you file for bankruptcy under Chapter 7 or Chapter 13.

Disadvantages of Bankruptcy:

- A bankruptcy can remain on your credit record for 7-10 years and can affect your future finances and ability to borrow funds.

- A bankruptcy may impede your chances of getting a mortgage or car loan for some time.

- Not all debt will be discharged. Examples of debt that cannot be discharged include child support, alimony, some student loans, divorce settlements and some income taxes. You should check with an attorney on the specific categories of debt that will be allowed for discharge.

ACCC is a 501(c)3 organization that provides free credit counseling, bankruptcy counseling, and housing counseling to consumers nationwide in need of financial literacy education and money management. For more information, contact ACCC:

- For credit counseling, call 800-769-3571

- For bankruptcy counseling, call 866-826-6924

- For housing counseling, call 866-826-7180

- Or visit us online at www.consumercredit.com

About American Consumer Credit Counseling

American Consumer Credit Counseling (ACCC) is a nonprofit credit counseling 501(c)(3) organization dedicated to empowering consumers to achieve financial management through credit management counseling, debt management, bankruptcy counseling, housing counseling, student loan counseling and financial education. Sometimes the best possible debt solution for consumers is bankruptcy. ACCC is approved by the Department of Justice to provide the mandated pre-filing bankruptcy certificate for completed counseling and the post-bankruptcy debtor education certificate that is necessary for bankruptcy to be discharged. ACCC’s certified credit advisors work with consumers to help them determine the best plan of action to get out of debt and regain financial stability. ACCC holds an A+ rating with the Better Business Bureau and is a member of the National Foundation for Credit Counseling® (NFCC®). For more information or to access free personal finance resources, log on to ConsumerCredit.com or visit https://www.consumercredit.com/debt-programs/bankruptcy-counseling/