Of consumers polled by American Consumer Credit Counseling, 67 percent of those who currently have student loans don’t know the difference between federal and private loans and 60 percent don’t know if they qualify for relief or forgiveness programs.

Boston, MA – June 10, 2016

Of the respondents who have student loans, 54 percent have federal loans, 15 percent have private loans and 30 percent have both federal and private loans. The survey found that of those with student loans, a majority expect it will take more than 20 years to pay off their loans.

“With average students graduating with more than $35,000 in student loan debt, it is important that they understand the different types of loans they have,” said Steve Trumble, President and CEO of American Consumer Credit Counseling, which is based in Newton, MA. “In the end, students are responsible for the terms of their loans. It is extremely important that they take the time to fully understand their loans and the different payment options that are available to them.”

According to the survey, 46 percent of respondents have student loans between $5,000 and $60,000, 22 percent have between $60,000 and $100,000 and 13 percent owe more than $100,000 in student loans. Out of these respondents, 45 percent have a monthly payment under $999, while 35 percent who have student loans admit they have not calculated their monthly payments.

While repayment timelines varied widely, 35 percent of respondents expect to be paying off their student loans for 15 years or more. Of these respondents, 36 percent are not aware of the interest rate or the repayment terms they have on their loans.

Although 76 percent of respondents who currently have student loans are aware of their deferment or forbearance status, a majority, 62 percent of respondents have not taken a student loan counseling course.

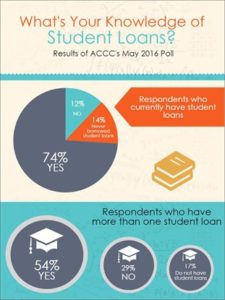

The online poll of 149 participants was conducted by American Consumer Credit Counseling on the organization’s website, http://www.consumercredit.com. You can view an infographic illustrating the poll results HERE : https://www.consumercredit.com/debt-resources-tools/infographics/information/whats-your-knowledge-of-student-loans/

ACCC is a 501(c)3 organization that provides free credit counseling, bankruptcy counseling, and housing counseling to consumers nationwide in need of financial literacy education and money management. For more information, contact ACCC:

- For credit counseling, call 800-769-3571

- For bankruptcy counseling, call 866-826-6924

- For housing counseling, call 866-826-7180

- Or visit us online at http://www.ConsumerCredit.com

About American Consumer Credit Counseling

American Consumer Credit Counseling (ACCC) is a nonprofit credit counseling 501(c)(3) organization dedicated to empowering consumers to achieve financial management through credit counseling, debt management, bankruptcy counseling, housing counseling, student loan counseling and financial education. Each month, ACCC invites consumers to participate in a poll focused on personal finance issues. The results are conveyed in the form of infographics (https://www.consumercredit.com/debt-resources-tools/infographics) that act as tools to educate the community on everyday personal finance issues and problems. By learning more about financial management topics such as credit and debt management, consumers are empowered to make the best possible financial decisions to reach debt relief. As one of the nation’s leading providers of personal finance education and credit counseling services, ACCC’s certified credit advisors work with consumers to help determine the best possible debt solutions for them. ACCC holds an A+ rating with the Better Business Bureau and is a member of the National Foundation for Credit Counseling® (NFCC®). To participate in this month’s poll, visit http://www.ConsumerCredit.com and for more financial management resources visit http://www.TalkingCentsBlog.com.