If you have credit card debt, a mortgage, student loans, or any other type of debt, it is crucial that you know how to handle debt management. The first step towards debt relief is getting organized. Let’s look at how to pay off debt by simply organizing your bills and creating a calendar.

- Start by physically gathering current statements for all of your debts including credit card debt, student loans, mortgage, car loans / leases, etc. Also, include any other bills you pay monthly such as utilities (electricity, gas, cable, and internet). Also, don’t forget to include a rent payment (if you are paying that). Organizing all of your debts and bills into one space can be especially difficult with tools such as electronic banking and automatic bill pay because they are easy to forget about. Review your check book and online statements to help you find specific bills and payments. Don’t forget to include bills that are paid on a weekly, quarterly, or annual basis.

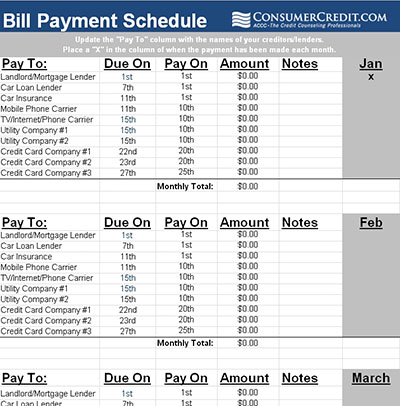

- Once you have created a list and gathered all of your statements, it’s time to organize! Begin by organizing your statements by due date. Mark each of these due dates on a calendar. You download ACCC’s bill payment calendar shown below for free. Print this spreadsheet and hang it in a safe place or simply reference it on your computer. Be sure to mark each month. Creating a calendar is one solution to how to manage debt.

Now that you have created a calendar of all of your due dates, how should you store your bills? Keep reading for more tips.

Organize your bills by category; for example, credit card debts, education debts, or utilities. Punch holes in your statements and put them in a binder, divided by category. Or, you could organize your bills alphabetically if this makes more sense for you. By storing all of your bills in one place, you will have an easy reference if you ever have a discrepancy.

Though organization alone will not pay off debt, it’s a great tool to help you learn how to get out of debt. Check back for more tips on how to manage debt, how to get out of debt, how to track debts, how to prioritize debts, and more.

If you’re struggling to pay off debt, schedule a free credit counseling session with ACCC today.