Unlike debt settlement, a debt management program won’t adversely impact your credit rating.

Unlike debt settlement, a debt management program won’t adversely impact your credit rating.

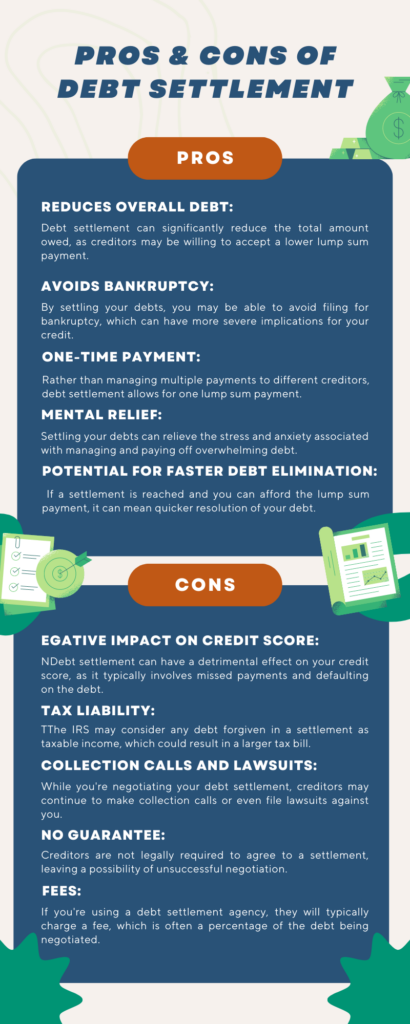

Pros & Cons of Debt Settlement

Before you enter a debt settlement program, it’s important to understand debt settlement pros and cons and whether this strategy for paying off debt is really the best option for your situation.

How does debt settlement work? Under a debt settlement arrangement, you’ll stop paying your bills until your accounts are seriously overdue. At that point, your debt settlement agency will approach your creditors and offer to settle your debts for an amount that is less than the total owed.

What are debt settlement pros and cons? On the plus side, some creditors may except your settlement offer, believing it is the easiest and most advantageous option for them to get some money from you. But on the negative side, other creditors may reject the offer and turn your account over to a collections agency or sue you for the balance plus legal fees. In this case, you may end up owing even more money. If your offer is accepted, you’ll pay a large fee to the debt settlement agency – usually 25% of the amount you saved – and you’ll likely pay taxes on any amount that was forgiven by your creditors, further reducing the amount of your savings. Either way, going through the debt settlement process will undoubtedly impact your credit.

How bad is debt settlement for your credit? Debt settlement can significantly damage your credit rating, making it difficult for years to get loans, apply for credit cards, or get a mortgage or an apartment. That’s why, before signing with any debt settlement companies, it’s a good idea to consult with a financial professional about debt settlement pros and cons and the best debt settlement options available to you.

Understand Debt Settlement Pros And Cons With Help From ACCC.

At American Consumer Credit Counseling (ACCC), we offer free credit counseling where you can learn about debt settlement pros and cons, as well as other options for getting out of debt. Our professionally certified credit counselors will work with you to understand your financial situation and explore a variety of strategies for paying off your debt as quickly as possible. In addition to discussing debt settlement pros and cons, we can help you understand the advantages and disadvantages of bankruptcy vs settlement and direct you to social service resources and educational materials that can help you determine the best path out of debt.

Debt settlement pros and cons versus debt management.

When considering debt settlement pros and cons, many consumers ultimately decide that debt management is a better tactic for resolving their debt issues. Unlike debt settlement, a debt management program won’t adversely impact your credit rating. Instead of refusing to pay your creditors, you’ll get help from our team to manage your finances more effectively and to pay your creditors on time each month. We’ll also work with your creditors to seek reductions in your interest rates and monthly payments, and to have late fees and other charges waived to help you pay down debt more quickly. To learn more about debt management versus debt settlement pros and cons, contact us today to schedule your first free credit counseling session.

Unlike debt settlement, a debt management program won’t adversely impact your credit rating.

Unlike debt settlement, a debt management program won’t adversely impact your credit rating.