50% of college students have four or more credit cards. That’s more than any responsible person needs. Many students use cards to either live beyond their means (which is against our credit counseling advice) or pay for tuition and other education expenses. But when bills aren’t paid in full every month, the cost of education becomes even higher than it already is.

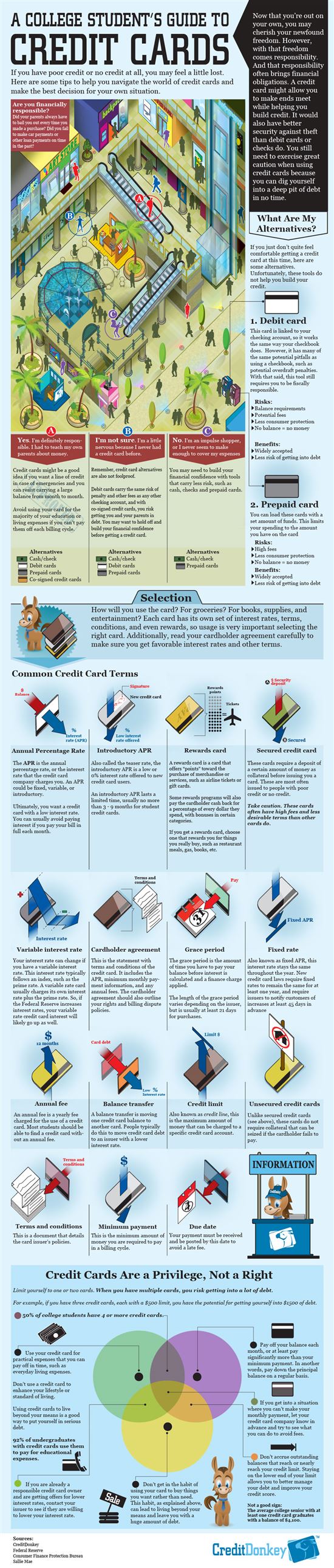

The average graduating senior holds credit card debt of $4,100 – a 70% increase from 2004. Here is an excellent visual guide to help students understand credit cards, and decide if and how to use them. Courtesy of CreditDonkey.

Courtesy of: CreditDonkey

If you’re struggling to pay off debt, ACCC can help. Schedule a free credit counseling session with us today.