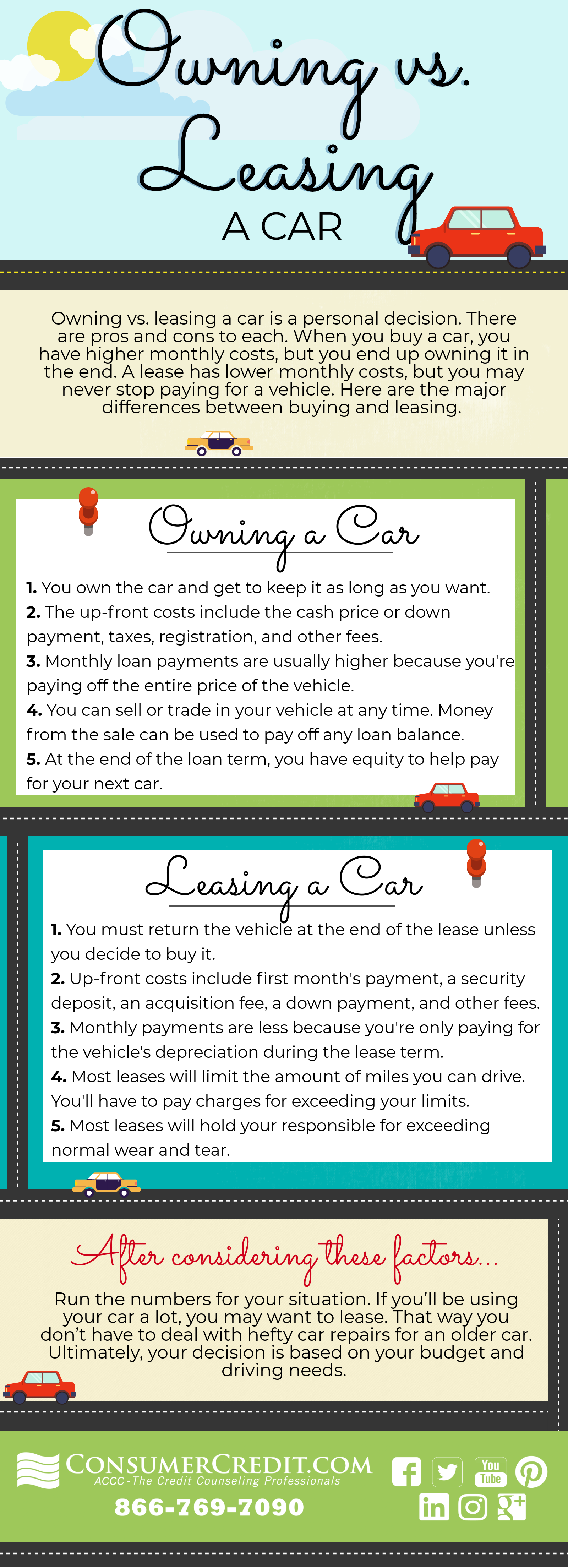

Owning vs leasing a car is a personal choice. However, other factors such as your current financial situation, your credit score, and debt management efforts matter a lot in the decision as well. There are pros and cons to each option. You need to carefully evaluate these to figure out what option fits you best. Let’s look at the major differences between owning vs leasing a car.

Owning vs Leasing a Car

Owning a Car:

When you buy a car instead of leasing you are the owner of the car. Since it is an asset that belongs to you, you can keep it as long as you want. When you buy a car your upfront costs include your down payment, taxes, registration and other fees. The biggest downside to owning a car is that your monthly payment is higher as you are paying the entire price of your car. With the ownership, you can trade your car at any time and use that money towards a new car at your will. Also, at the end of the loan term, you have equity to help pay for your next car.

Leasing a Car:

With a lease, ownership of the car is not yours. Therefore, at the end of the lease term, you must return the vehicle. When leasing a car the upfront costs include first month’s payment, a security deposit, an acquisition fee, a down payment and other fees. The advantage of leasing a car is lesser monthly payments. This is because you are only paying for the vehicle’s depreciation during the lease term. One of the biggest downsides is the limitation on miles. You will have to pay charges if you exceed these limits. Also, a majority of leases hold you responsible for exceeding normal wear and tear.

Owning vs Leasing – What’s my choice?

You can carefully consider all the above factors and run the numbers depending on your situation. Your ultimate decision is based on your budget and the type of travel you do. Good luck with your new car!

If you’re struggling to pay off debt, ACCC can help. Schedule a free credit counseling session with us today.