Consumer debt can be overwhelming and limiting in a number of ways. A solution to the chaos can be debt consolidation. But is debt consolidation wise? Let’s consider consolidation and evaluate its strengths and weaknesses as a debt solution.

Debt Consolidation Loans and Programs

Debt consolidation is the process of joining all of your current debts into one new loan. Generally, debt consolidation means taking out a new loan to replace your existing loans with one new interest rate & due date. This process can be helpful for those who are struggling to make payments to multiple creditors each month. It’s also helpful for those having trouble keeping track of different due dates.

For debt consolidation to save you money, you must secure a lower interest rate than you currently hold. Otherwise, you could pay more towards your debts in the long run. Also, taking out a consolidation loan without addressing the cause of your financial problems can lead you down the same path of accruing debt – this time with another loan at risk.

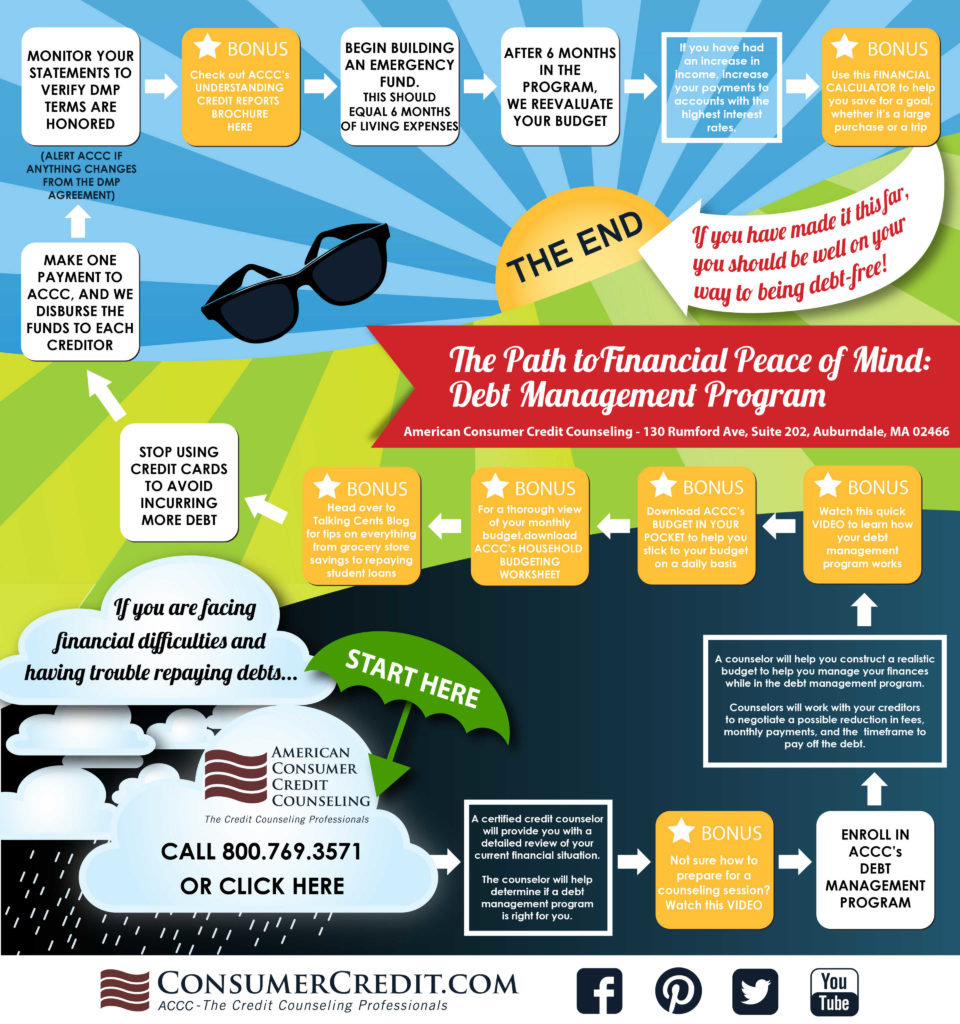

National nonprofit American Consumer Credit Counseling (ACCC) can help you consolidate your debt without taking out a new loan. ACCC’s debt management program is one of the best alternatives to a traditional consolidation loan.

A debt management program (DMP) allows you to consolidate all of your current debts into one without borrowing more money to pay your existing debts. When you enroll in a DMP, a certified credit counselor at a non-profit agency, like ACCC, will negotiate with your creditors to reduce interest rates, outstanding late fees, and any over-limit fees.

So Is Debt Consolidation Wise For Me?

Everyone’s finances are unique. Therefore there is no black and white answer. If your credit is in good standing and you don’t typically struggle with debt, a debt consolidation loan could work well. Consumers with many debts and struggle to manage their finances, would probably benefit from more guidance in a DMP. Review your finances, do some research and decide if it’s true: is debt consolidation right for you?

For more information about getting out of debt, sign up for a free credit counseling session with us today!