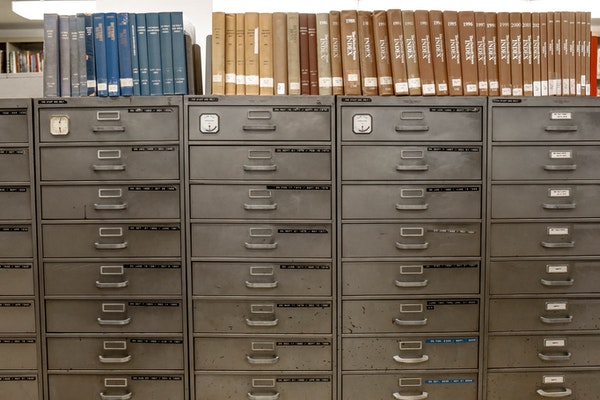

We’ve given you financial spring cleaning tips, actual spring cleaning tips, but what about spring cleaning your files? Our credit counseling advice is to be organized with your financials. Part of being financially literate and responsible is knowing where your important files and financial records are at all times, and being able to access them. The best way to do this is to make sure your filing cabinets are properly organized.

First, create a financial fundamentals drawer. This is where you keep your personal papers, like birth certificates and Social Security cards. Tax returns, with the related documents, should also go here, going back seven years. Include any deeds or titles that you might own, as well as title insurance. Keep all of these items well organized with labeled folders.

Then, create an emergency protection and prevention drawer. This is where all insurance information goes, including the terms of your policy and your payment information. You should also keep a household inventory here, including any identification numbers and the make/model of anything of value in your home. Any hard drive backups can also go here.

The financials drawer may end up becoming two, with the amount of information stored here. This is where you put anything related to your paycheck – stubs, employee benefit statements, retirement statements, and the terms of your benefit and retirement plans. You can also store any debt documentation and credit card statements in this drawer. If you have any other investments, you can keep all relevant information here as well. Do you make charitable donations? Keep the information in a folder here for easy access when you file taxes.

The major illness or death drawer contains all of the valuable information needed on hand in the event of a major illness or death. This can include the power of attorney, any documentation on living trusts, and your will. You may also need to include your life insurance policy, or any living will wishes. The idea is that this drawer should be easily accessible for your executors and beneficiaries. If they don’t know where to find this information, your wishes may not be carried out properly.

Most importantly, you need a master document that explains any bank accounts, bills, or safety deposit boxes that you may have. Understand that if you pass away, the knowledge of these accounts disappears. If you want to make it easier on your family in the event of your death, use a master document that explains all of your wishes clearly and where your family can find the necessary documentation they may need. You should also make copies of the important documents and keep them in a safety deposit box, if you have one. If you do choose to use a safety deposit box, make sure your loved ones know how to access it.

If you’re struggling to pay off debt, ACCC can help. Schedule a free credit counseling session with us today.