Budgeting is a critical and helpful element to managing personal finance. However, a budget can also be difficult, cumbersome and limiting. So how can you deal with the hard reality of budgeting, debt management and living life? Let’s learn about the ups and downs of budgeting so you can be prepared and stay the course.

How to Manage the Hard Reality of Budgeting & Living Life

While budgeting is often lauded as the key to having what you want in life, it comes at a cost. Time and time again a budget will force you to say no. No to the big vacation. No to another meal out at a restaurant. And no to quitting that second job for a while.

That’s a lot of no’s. It can be extremely tiring to always hear no! It’s not very motivating. And just when the budget starts working and making progress, another financial hit comes along. That hit turns an almost yes project back into a no.

So why do we do it?!

Fortunately, if you stick to the budget (and with a little luck), you can eventually start saying yes again. You’ll be in debt recovery. Money will be saved. Goals reached! Financial independence at last.

How a Budget Can improve Your Life

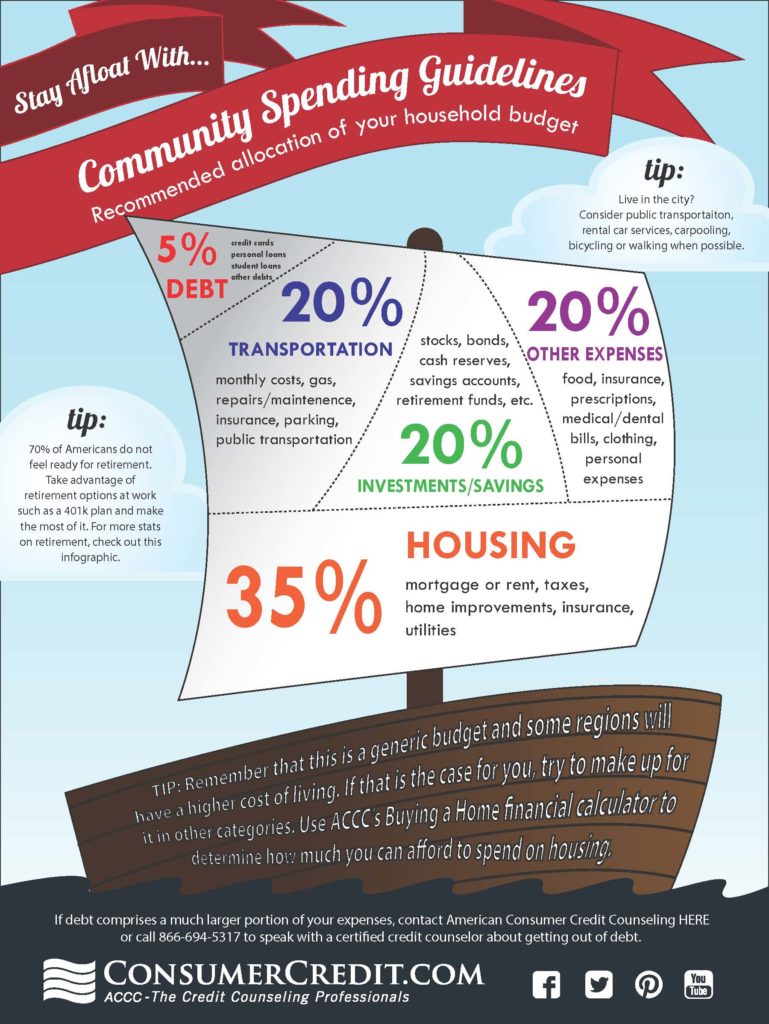

A budget is a guide. It tells you whether you’re going in the direction you intend. You may have goals and dreams. However, it’s important to set up guidelines to measure your progress. Failing to do so will send you in the wrong direction. Can you imagine the government or a major corporation operating without a budget? No, and neither should you.

- A budget will tell you if you’re living within your means.

- Following a realistic budget frees up spare cash so you can use your money on the things that really matter to you instead of frittering it away on things you don’t even remember buying.

- A budget helps you prepare for emergencies or large or unanticipated expenses.

- A budget can improve your marriage. A good budget is not just a spending plan; it’s a communication tool.

- A budget can keep you out of debt or help you get out of debt.

- A budget actually creates extra money for you to use on things that matter to you.

How to Stay Motivated

The hard reality of budgeting isn’t always looming. A budget can also provide tremendous relief. That emergency fund can seem like a miracle when big bills roll in. Knowing you have money saved for specific costs is a wonderfully comforting thing.

Adding to a car maintenance budget each month has proved itself worthwhile time and time again in our family. When major repairs have popped up, our maintenance fund has saved us from credit card debt or using our emergency fund.

Take a look at these budgeting tips when it’s tough to keep going:

- Create a visual reminder you can see easily and update- like a thermometer to fill in or a photo of your new house.

- Review the numbers each month to acknowledge the progress.

- Find ways to boost your efforts from time to time. Sell some items, work extra or do a spending freeze to give yourself more energy.

- Treat yourself a little bit to relieve some spending frustration.

- Plan future goals that bring joy and excitement rather than just focusing on eliminating debt.

- Stay connected and make it easy using a mobile friendly budgeting app.

- Finally, take a moment to remember how far you have come!

If you’re struggling to pay off debt, ACCC can help. Sign up for a free credit counseling session with us today.