Our debt counselors know that transitioning out of the military can be stressful. Whether you’ve been in the military for four years or twenty, it will be a huge life change. Like most life changes, transitioning out of the military will come with financial implications too. If you aren’t fully prepared, you could rack up a lot of consumer debt to stay afloat financially. Here are five of our financial tips for veterans.

1. Have an emergency fund.

When you search for a new job in the civilian world, you may find it takes longer than you expect. Job hunts can be unpredictable, and in the interim, you’ll still have to pay rent, buy groceries, pay your utilities, etc. Ideally, you should have three to six months’ worth of expenses saved in an emergency fund.

2. Pay off debt.

Try to pay off debt you may have before you separate from the military. This will help reduce other financial stress you may encounter post-transition. If you’ve just been paying the minimum on your credit card, pay it off entirely. That will be one less bill to worry about when you are in between jobs.

3. Know your options for your TSP.

When you start a new job, it’s a good idea to contribute to your new company’s 401(k). But what happens to your TSP from when you were in the military? You have three options:

- Rollover your TSP into your new company’s 401(k).

- Rollover your TSP into an IRA.

- Leave your TSP alone and let it continue growing, but you cannot make any more contributions to it.

If you are unsure what option is best for you, you may want to speak with a trusted financial advisor to get a professional opinion.

4. Redo your budget.

With a new salary and a new lifestyle, it is important that you redo your budget. You will have to adjust your income, and possibly some of your expenses as well. Maybe you lived on base before and could easily go to the commissary for your groceries. However, now you live too far from any base for it to be a practical option. Shopping at a “regular” grocery store will be a bit more expensive, so you will have to adjust that section of your budget.

5. Compare Tricare to the new employer’s health insurance.

You and your family can still have Tricare after you get out of the military, but before you decide to stay with Tricare, see what your new job offers for health insurance. Maybe your new job has better coverage and/or is more affordable, or maybe Tricare is the better deal. Either way, it’s worth looking into to make sure you and your family are covered by the best health insurance option.

Final Thoughts on Financial Tips for Veterans

The best financial move you can make when you transition out of the military is to have a plan! As long as you know you have planned ahead for your separation, it should be a relatively smooth transition for you and your family. If you’ve paid off your debts and created an emergency fund for the interim, the rest of the steps will be less stressful!

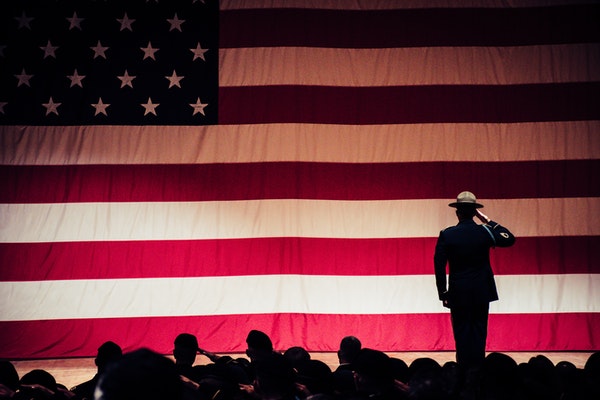

Thank you to all veterans for your service to our country!

If you struggle to pay off debt, ACCC can help. Schedule a free credit counseling session today!