- The amount of debt you have and

- Your financial goals

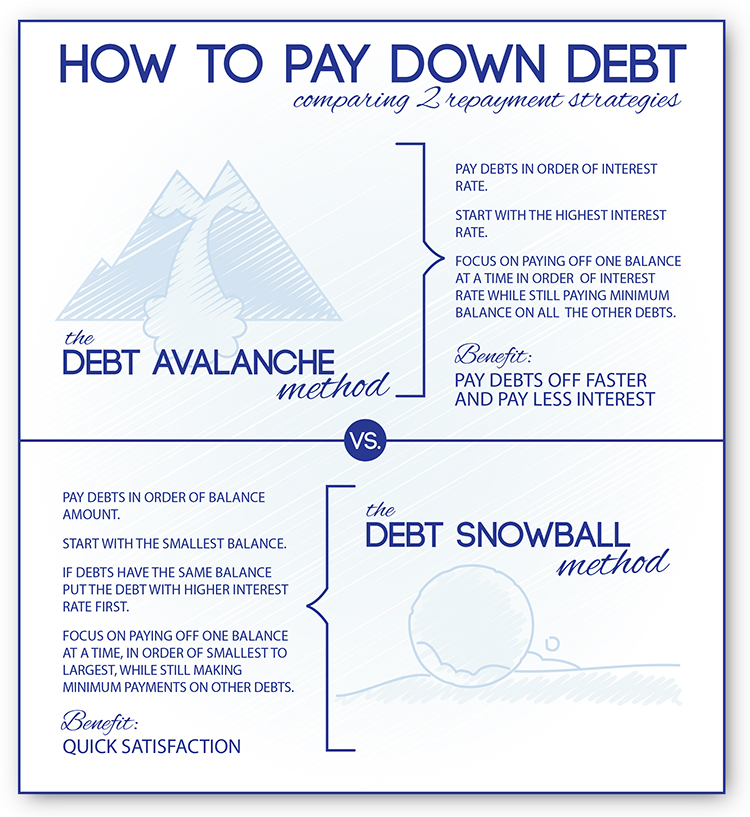

This particular post is focused on educating you on the debt avalanche method and how that can help you in the debt management process.

Debt Avalanche Method Explained:

Whichever path you take to tackle your consumer credit, you have to do a few things to begin the journey.

- List each of your debts in order from largest to smallest interest rate.

- Figure out average monthly income.

- Devise the plan to pay off debt.

Here’s the important thing you should know. Rather than asking “How do I pay off debt?”, the information you really need is “How do I pay off debt and learn to avoid it in the future?” If you do not choose the right strategy for your problem you may end up with the same or even more debt. If you begin the process by obtaining credit card loans or started a debt settlement process with a lack of information this can happen to you. Also, consumers must ensure that they have all the information to make the right financial choices and behaviors.

How the Debt Avalanche Method Works

The debt avalanche method is a quicker way to earn the returns on your money. This is because this method focuses on eliminating the most expensive debts first. Think of it this way. What really happens is that you stop the growth of compound interest by tackling the debts with higher interest first.

Let’s get to some number crunching to explain this scenario better. Let’s say you have three balances on your credit cards.

- $10,000 at 15% APR

- $ 8000 at 18% APR

- $ 5000 at 20% APR

Minimum payments on credit cards are typically calculated as 1% to 4% of outstanding balances on your credit cards. Hypothetically if you assume the minimum payment is at 1% you will take nearly two decades just to pay off the principal debt. Add the thousands of dollars on interest charges on these and you will not be able to pay off your debt in the foreseeable future.

However, if you use the debt avalanche method you would pay off the $5000 debt first even though it is not your largest debt. It is however the debt with the highest interest. Then you can move on to the debt with the next highest interest. If you follow this approach you will benefit by adding up the interest savings and will relieve your debts much sooner.

Is it a Better Alternative to Other Options?

- Take stock: This is the first step to any good debt pay off strategy. You take inventory of everything you owe. If you have made the choice to use this strategy, then you need to list the debts based on highest to lowest interest rates. This way you will know which debts to tackle first at a glance.

- Start paying the minimums: Staying current on all your debts is a crucial step to the success of this strategy. While you focus on paying off the credit card debt with the highest interest rate, you must ensure you pay the minimum balances of your other credit lines. This keeps you current and avoids fees and other charges. This will also reflect positively on your credit rating.

- Allocate extra money to the highest priority debt: Any additional money you have each month should go to the credit card pay off with the highest interest rate. This way you are effectively working on eliminating the debt you owe at a high rate. The savings you gain from this can later be applied to your other debts.

- Commit to continuation: It may seem overwhelming at first. However, commit to making payments. Use your budgeting tools to cut back on unnecessary expenses. Put the extra cash towards your debt. Once you have paid off your first loan take it off your priority list. Allocate the money you have been paying on that loan to your next due with the next highest rate. This discipline is what is going to take you through to the other side. Invest your time in financial education. Commit to cut back spending. Look out for ways to put more cash towards your debt. Reach out to reputable credit and debt counseling organizations for free financial advice that will help you through the process.

Other Means to Pay off Debt

Tackling your debt is not an overnight task. It is an evolving and exhausting task. Just as you make a list of your debts and prioritize your debts, you also need a structured strategy to manage your overall finances. The best first step to this process is creating a budget. You must ensure that your budget is realistic. In the sense that you have enough to cover your everyday expenses. You always have certain needs you have to cover and those are essentially non-negotiable. the disposable income thereafter is what you can prioritize for debt pay off. It is important that you work on your debt at the top of your list. Once you are in a comfortable situation with your debt you can then work on other crucial financial goals such as building up an emergency fund and saving for retirement.

Concluding Tips:

- Allocate the money to at least make the minimum payment on all your debts.

- Credit card balances need close attention. As these are more likely to accrue high-interest rates and drag you down to deeper debts sooner.

- Fully understand the information about what you owe. Interest rates, fees, charges, and all the information on the fine print.

- Prioritize your debts based on your financial strategy and commit to it.

If you are struggling with debt, ACCC can help. Schedule a free credit counseling session today!