Debt consolidation is one method some consumers use to pay off their debt. There is no “right” way to pay off debt, and what each consumer chooses depends on their own individual financial situation. The most important part of decision-making for consumers who are choosing the best method for paying off debt is determining the advantages and disadvantage of each option. American Consumer Credit Counseling outlines the advantages and disadvantages of debt consolidation:

What is debt consolidation?

First things first, what exactly is debt consolidation? Debt consolidation typically involves combining your different unsecured debts, such as credit card debt, student loans, etc. into a single loan. Instead of paying a separate bill for each credit card and loan every month, you only have one payment for all of them. This makes keeping on top of your bills easier because you don’t have to keep track of when each of these payments is due. The company administering this program will then pay each creditor on your behalf.

Where can you get started with this kind of debt relief? Various financial institutions offer debt consolidation loans. Like any other loan, you will need good credit for the best interest rate. The higher your credit score, the more likely it is that you will be approved and get a low interest rate.

Advantages of Debt Consolidation

Again, one of the main advantages of debt consolidation is that it’s easier for you. You only have to remember to make one payment instead of five or six, or however many accounts you have in the program. Another big advantage is that it can save you money. Credit cards often have high interest rates, but your new loan will likely have a lower interest rate. You may also have lower monthly payments as you pay the loan off over a longer period of time.

Additionally, a debt consolidation loan can help your credit score in the long-run. Payment history is the most significant factor in determining your credit score, so if you make your payments on this loan on time every month, your credit score should increase. Do keep in mind that there may be an initial drop in your score when you first apply. This is because any application for loans or new credit results in a hard inquiry on your credit. As long as you are not applying for too many new accounts at once though, you should be okay.

Disadvantages of Debt Consolidation

One of the biggest disadvantages of debt consolidation is that it is not accessible to everyone. If you have poor credit, you will probably not get approved for the loan. Even if you do, you might not be getting the best interest rate if your credit score is below 700. This cancels out the aforementioned advantage of saving money.

Plus, not all companies that offer debt consolidation loans are reputable. Some charge high fees and are more interested in taking your money than helping you pay off your debt. You could end up deeper in debt than when you started, defeating the whole purpose of debt consolidation.

Alternatives to Debt Consolidation

Debt Avalanche & Debt Snowball

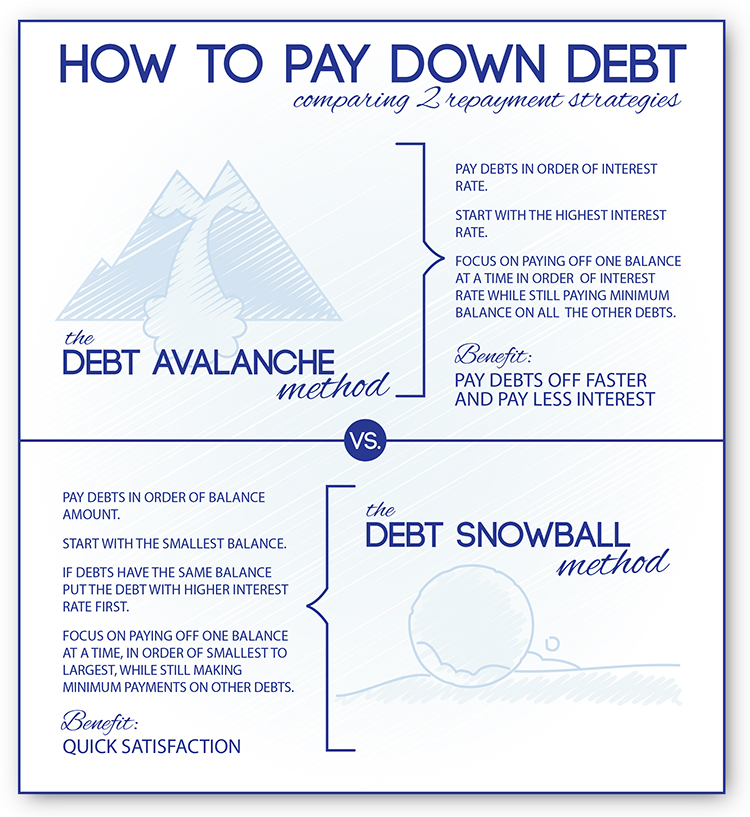

If you’re weighing your options and decide that the disadvantages of debt consolidation are too much for you, don’t worry! There are plenty of other options. In fact, you may not even need outside help at all. If you feel you are disciplined and financially stable enough, you might be able to become debt free on your own! There are two popular debt payoff methods for those who choose to do it alone. These methods are called the debt avalanche and debt snowball methods:

As the above infographic explains, the debt avalanche method involves paying off the account with the highest interest rate first. The debt snowball method, on the other hand, involves paying off the account with the highest balance first. The debt avalanche method would save you the most money, but the debt snowball method may be better at keeping some people motivated since there is a quicker sense of satisfaction.

Debt Management

However, not everyone is able to pay off their debt without help. That’s why they turn to debt consolidation or other financial institutions for assistance. Another option is a debt management program, which is similar to debt consolidation, but without the loan. This program is administered by a nonprofit credit counseling agency, and combines your unsecured debts into one monthly payment. The credit counseling agency disburses your payment to your different creditors from there.

Credit counseling agencies negotiate lower interest rates with some creditors, so your monthly payments are lower than what you would be paying otherwise. Additionally, because they are nonprofits, they do not charge high fees like other companies. They also provide you with financial education materials so you can learn how to get back on track financially after struggling with debt.

Be sure to check that the credit counseling agency is licensed in your state and all their credit counselors are certified. The agency should also be a member of either the AICCCA or the NFCC if it is really a reputable agency. All of this information should be readily available on their website.

A Word of Caution…

Be careful of debt settlement companies! They do NOT offer traditional debt consolidation or debt management programs. These companies will allow you to settle your debt for a lower amount than your principal balance, meaning you are not actually paying off all your debt. This can be hugely detrimental to your credit, and the debt that you end up not paying can be counted as income by the IRS. Though it may sound like a good idea to begin with since it looks like your saving money, debt settlement does more harm than good.

Conclusion

While debt consolidation can be a great option to pay off debt, it is certainly not for everyone. Before you make a decision on how to pay off your debt, look at your overall financial picture to determine what option is best for you. Make sure you do your research on any company, whether it is a debt consolidation company or a credit counseling agency, before you decide to work with them.

If you are struggling to pay off debt, ACCC can help! Schedule a free credit counseling session with us today.