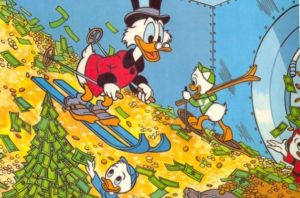

Growing up, I never would have thought that Scrooge McDuck would be a good role model. His cantankerous nature didn’t seem appealing; he just seemed greedy and mean. While it looks like Scrooge is sitting idly by on his money, his wealth is actually circulating in the economy and growing. His giant pile of money shows great financial discipline, and he is willing to share his secrets. Surprisingly, in our credit counseling opinion, you can gain a lot from Scrooge McDuck economics.

In this video from Scrooge McDuck, children learn basic economic principles of balancing budgets, taxes and financial discipline.

Economics for Kids

Movement of Money

Between income, spending, taxes and investing, money is constantly moving and changing hands in the economy. It’s important for kids to understand that while income taxes seem unfair at first, the government uses that money to help us with safety, transportation, education and more. Finally, Scrooge McDuck tells us that it’s a good thing that money circulates; this is what drives economics and makes it all possible. Sometimes, more money flows out than flows into a bank account. Too much movement of your money can lead to consumer debt. Let’s see what Scrooge says about saving and spending.

Financial Discipline

Practice, Practice, Practice!

Knowing that bills and needs come first sounds easy enough, but many struggle to get out of debt every day. Somewhere along the way, they have not learned financial discipline. Instead of creating a budget and sticking to it, they might think everything will work itself out, debt is normal or they make a “budget” in their head. Learning to successfully budget and save as a kid will be a positive experience to take with them as they grow. As an adult, it’s a way to take back control.

Budgeting for Life

Start Now

How is your financial discipline? The more we learn and practice, the better we will be with our personal finances. And this goes for any age! Remember, Scrooge McDuck did not amass his wealth overnight. Try writing out a budget if you never have. Don’t be afraid to make changes month to month or ask questions. If you are really good at budgeting, be sure to share that knowledge with your kids or friends.

If you’re struggling to pay off debt, ACCC can help. Schedule a free credit counseling session with us today.