It’s been quite some time since I last wrote for the blog, but with the holidays approaching and our recently released challenge to consumers to commit to a cash-only challenge, I decided to do something I’ve never done before – create a budget for my shopping and holiday festivities. You know what I realized? I should have started planning (and saving!) for this months ago, but I am committed to sharing my holiday spending journey and challenging myself to give my credit cards relief this season. Enter – the cash-only Christmas. This will help prevent overspending – which is especially great if you’re already working on debt management.

My first step: Create a Budget

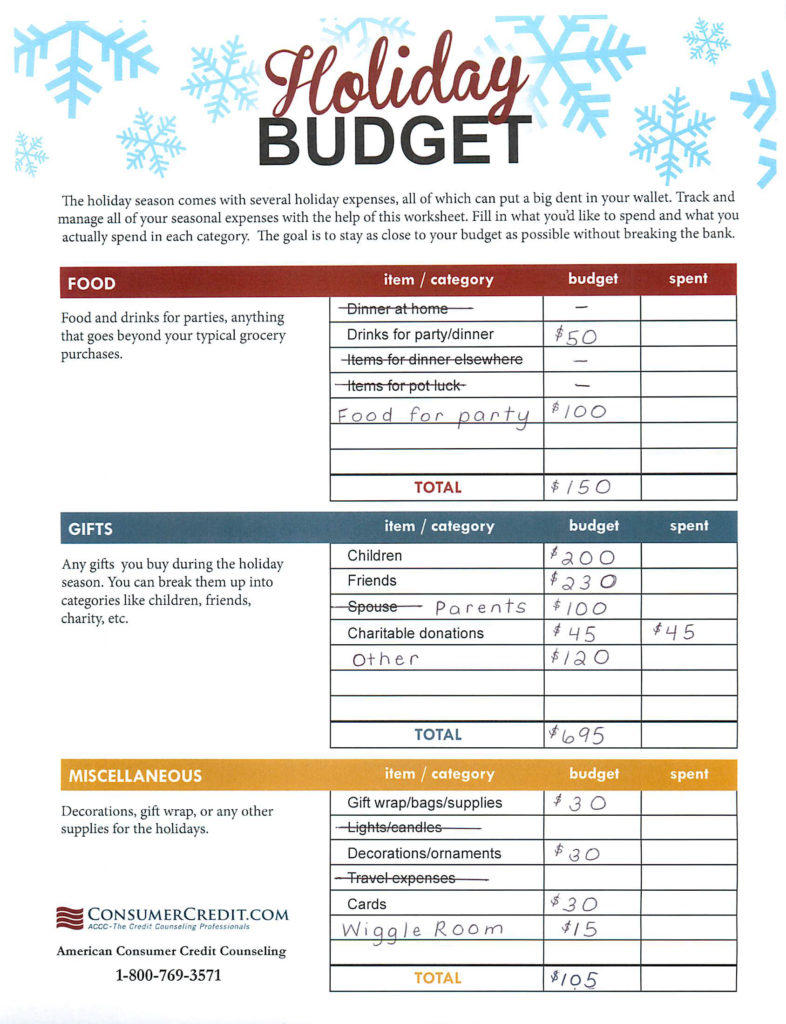

First, I downloaded our Holiday Budget Worksheet and divided my spending into three categories: Food, Gifts, and Miscellaneous. As you can see I made my own adjustments to this worksheet and even left myself with “wiggle room” under Miscellaneous for the chance that I go over in any category. I am one who succeeds off of small victories and I believe that I over-budgeted for some gifts and scenarios. I am hoping that when this challenge is over I will come in under budget and it will encourage me to pay down my credit card debt in 2014.

Here’s how my budget breaks down:

Food for my Annual Holiday Party:

Drinks: $50.00

Food: $100.00

Gifts:

Kids (not mine!): $200.00

Parents: $100.00

Friends: $230.00

Other: $120

Charitable Donations $45.00

Miscellaneous:

Gift wrap/bags/supplies: $30.00

Decorations/ornaments: $30.00

Cards: $30.00

“Wiggle Room”: $15.00

Total Budget for Holidays 2013: $950.00

Percentage budgeted on Food: 15.7%

Percentage budgeted on Gifts: 73.2%

Percentage budgeted on Miscellaneous: 11.0%

That number was higher than I expected it to be, but once I got over my initial shock and thought about my spending from last year, it is likely in line or less than what I spent. My goals for this challenge are…

- Create a budget

- Spend cash only (I count debit card as cash and I will explain that in next week’s post on about my spending game plan)

- Come in under budget (I am shooting for only spending $800.00 or shaving 16% off my budget)

I hope you will follow me in my cash-only Christmas following journey this holiday season!

If you’re struggling to pay off debt, ACCC can help. Schedule a free credit counseling session with us today.