Financial literacy can start very early. In fact, the sooner the better! Teaching your children about money and responsible financial habits can be done through a chore chart and allowance. Learn more about creating your own chart and giving an allowance.

How to Make a Chore Chart With Allowance

Experience is a great way to build successful money management skills in kids. One of the best ways to teach your children about money is to have them work for it. Your kids will probably take better care of their things and spend more carefully if they have to earn it themselves.

Introduce your child to the idea of working to earn money. Use yourself as an example! Describe what you or your spouse does for a living to earn the money to take care of the family. Then, designate some jobs your child can do around the house so that he or she may be able to earn money.

Clarify that some things you do around the house are expected and some things will earn them an allowance. Allocate a specific dollar amount per job. You can start younger children with simple chores, like making the bed, clearing the table, or maybe helping feed your pets. As they get older, they can take on more difficult chores. Remember to be consistent with the rules, rewards, and consequences of whatever system you put into place.

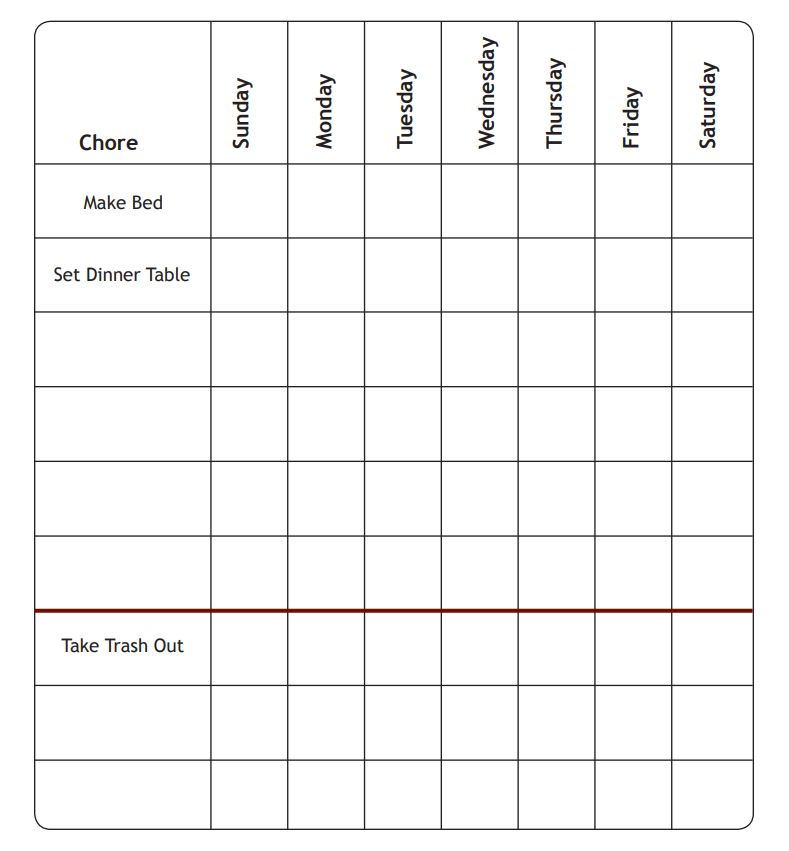

Chore Chart Example

Use this Chore Chart so that you and your child can keep track of the chores that have been completed each week.

Add all the chores that need to be completed and check them off or use stickers. The chores below the maroon line are chores that earn money. However, they need to have completed all their regular chores and their money making chores for the week to earn an allowance. You can make each chore worth a quarter or even a dime to start. Additionally, it might be a great opportunity to buy or make a bank as well for all their earnings.

Finally, remember that a child’s relationship with money is heavily tied to how they see their parents use and interact with money. Try to set a good example for your children and involve them in any financial decisions that you see fit. And make sure you account for allowance in the monthly budget.

If you’re struggling to pay off debt, ACCC can help. Schedule a free credit counseling session with us today.