When I signed up for my bank account before I went off to college, I was given the option of enrolling in a Keep the Change savings program. As a young (and somewhat naïve) seventeen year old, I made the choice to enroll without knowing much about the program, or anything related to banking, saving, and money management.

Since August 2008, I have saved $496.29, averaging $99.26 per year. Although this may not seem like a lot when you break it down to yearly savings, every little bit helps (I cannot seem to find an exact number for my savings since my enrollment in 2007). This is especially true when you’re trying to pay off debt.

Here’s how it works:

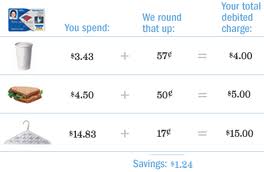

Each purchase you make on your debit card enrolled in the program will be rounded up the nearest dollar amount. For example, if you purchase a coffee for $3.50, it will be rounded up to $4. The difference will then be transferred to your savings account (in this case, $0.50). For the first three months, 100% of your savings is matched to the penny, with a maximum of $250 credited to your savings account. Essentially, that’s $250 of free money! After the first three months, you earn a 5% match. (You must have a checking account, debit card, and savings account to enroll in this particular program.)

I use Bank of America, but many banks have programs similar to this one. What I like about this program is it forced me to start saving when I probably wouldn’t have been regularly, even if it was just a very small amount. As a teenager, it allowed me to see how quickly even small amounts of money could add up.

However, there are many skeptics to this program. Some say they began using their debit card for purchases they would not normally make just to earn the “change.” Others criticize fees associated with it; however, I carefully scrutinize my spending and saving and I have not been charged any fees to maintain the account. Others criticize the relatively low interest rate. While I do use this account and program often, it is not my only means of saving. I have another savings account with a higher rate that I transfer money to regularly.

Essentially, the program is a virtual change jar. So, why not extend this concept to cash? For example, keep track of all of your cash purchases throughout the week and at the end of the week, deposit the difference into a physical change jar, or even better a savings account.

I have started doing this and have taken the liberty to 100% match my savings. For example, if I buy lunch for $8.50, I round up to $9 just as the program does. I add this $0.50 to a running list of my cash purchases and then at the end of the week I double my total and deposit it. You can track your purchases the old-fashioned way using a pen and paper, or you can use a smartphone app to track your cash purchases. I fall somewhere in between and track my cash purchases on the Notes function on my phone.

Although it’s not my main means of saving, it has helped me get into the routine of saving, which is important for building and maintaining financially responsible habits in the future.

If you’re struggling to pay off debt, ACCC can help. Schedule a free credit counseling session with us today.