Use ACCC’s financial calculators to help you better track your budget, mortgage, and other important expenses. Therefore, they can help you better manage your money. These calculators are designed to give you the clearest sense of your financial situation. Additionally, help you make the most informed financial decisions possible for your future and keep consumer debt at bay.

Financial Calculators From ACCC

American Consumer Credit Counseling offers a variety of financial calculators across multiple categories to help you manage your finances and work towards debt recovery. These categories include:

- Budgeting & Life- ACCC offers a number of calculators under this category. They include an emergency fund calculator, entertainment planner, saving for a goal calculator, travel budgeting and more.

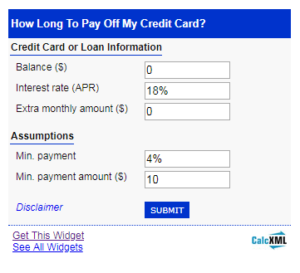

- Credit & Debt – Similarly, under the credit and debt category, you can find calculators to find out if you should consolidate your debt, the cost of credit, a debt payoff calculator, the cost of your loan and more.

- Education & College – This category offers calculators including back to school budget, building an education fund and repaying student loans.

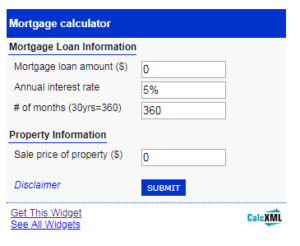

- Home & Mortgage – Under the home and mortgage category, ACCC offers calculators for you to know how much house you can afford. Also, there is a calculator to help you decide if you should refinance your mortgage.

- Career & Retirement – This category offers calculators on a retirement fund, inflation’s impact on retirement, how to save a million, and more.

- Auto – Finally, this category offers calculators on how much car you can afford and on auto loan payments.

So, to help you get a better picture of our financial calculators, we’ve included some examples:

Check out other all of ACCC’s financial calculators and start organizing your finances today. If you are struggling to pay off debt, ACCC is here to help you. Schedule a free credit counseling session with us today.