It does not come as a surprise to anyone that achieving financial success is the most difficult task to take on. And it is not a simple step by step process by any means. However, a guideline as to how you can achieve financial success sure does help in all your debt management efforts.

What Does The Path to Financial Success Looks Like?

Though the path to financial success can look different for everyone there are typically a few key steps that consumers should take in order to achieve financial freedom.

One of the most crucial steps is paying off debt. Debt is a burden that can quickly spiral out of control and ruin your finances if you don’t take action. Another important part of financial success is saving money. This includes saving for emergencies, retirement, and other financial goals. Most experts recommend having three to six months’ worth of expenses saved in an emergency fund. Even if you can’t save a lot of money just yet, putting away even $20 a month adds up over time.

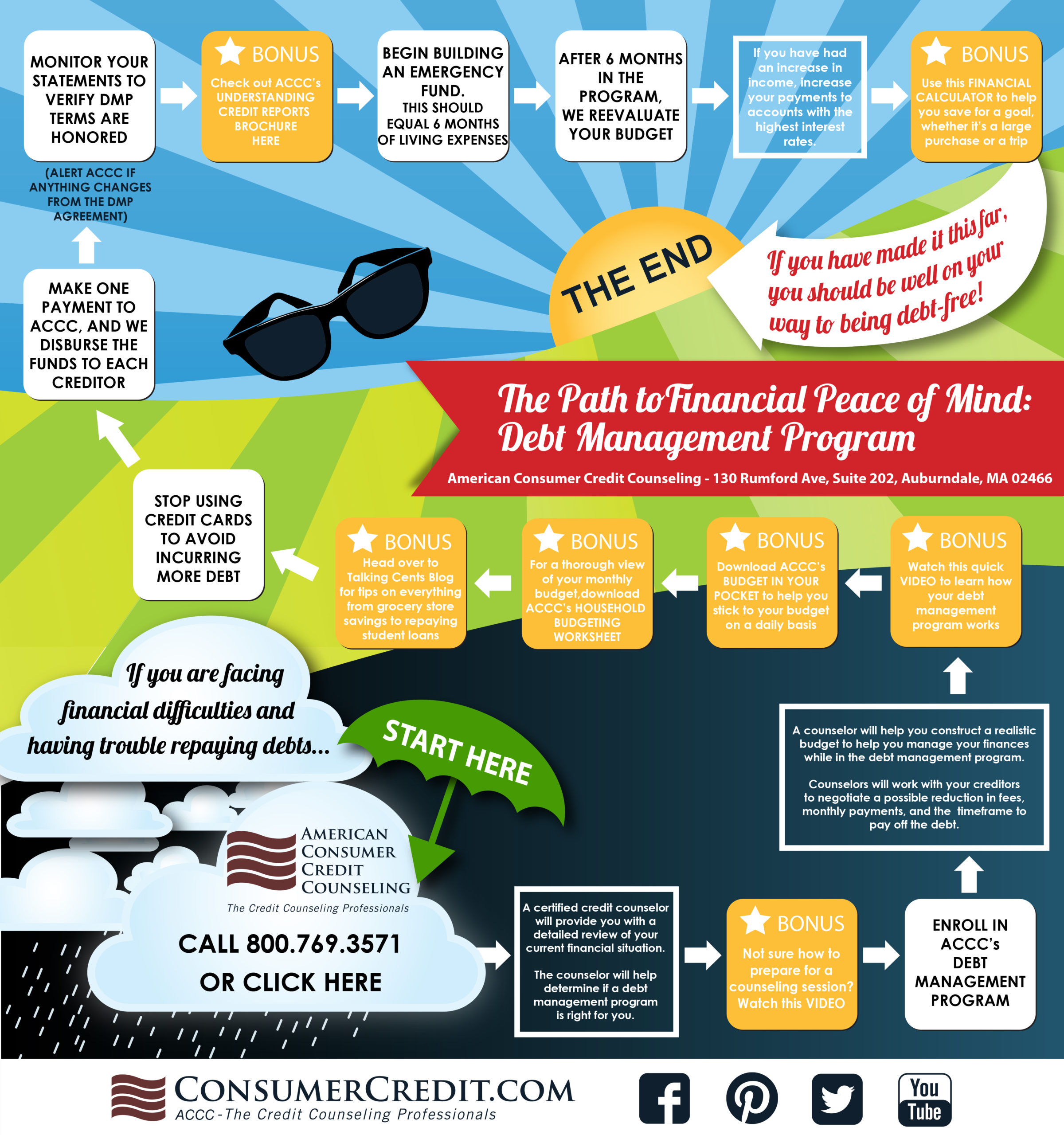

The infographic below illustrates how consumers that have significant of debt can get back on track financially.

How Can ACCC Help?

American Consumer Credit Counseling (ACCC) is a non-profit consumer credit counseling agency. We provide free credit counseling and low-cost debt management services. As an alternative to a credit repair and debt relief, we provide credit counseling to help consumers find the credit card debt help they need to get out of debt for good. The highly trained and certified counselors at our can provide information about the pros and cons of online debt consolidation and other debt consolidation services, as well as information about how to consolidate debt with bad credit. Therefore, you can start your path to financial success with ACCC.

If you struggle to pay off debt, ACCC can help. Schedule a free credit counseling session with us today.