Recently, there has been a lot of news surrounding the Public Service Loan Forgiveness program. And unfortunately, most of the news hasn’t been good. If you are hoping to have your loans forgiven or need to apply, read this article to find out the latest news about student loan debt.

Public Service Loan Forgiveness Basics

The PLSF program began about 10 years ago to help and encourage students entering a career in public service with Federal student loans. The program would forgive the remaining balance of the Direct Loans after you have made 120 qualifying monthly payments under a qualifying repayment plan while working full-time for a qualifying employer.

Here are some of the qualifying employment options:

- Government organizations at any level (federal, state, local, or tribal)

- Not-for-profit organizations that are tax-exempt under Section 501(c)(3) of the Internal Revenue Code

- Other types of not-for-profit organizations that are not tax-exempt under Section 501(c)(3) of the Internal Revenue Code, if their primary purpose is to provide certain types of qualifying public services

And here is what they mean by full-time employment:

- Meet your employer’s definition of full-time or work at least 30 hours per week, whichever is greater.

- If you are employed in more than one qualifying part-time job at the same time, you may meet the full-time employment requirement if you work a combined average of at least 30 hours per week with your employers.

While this seems fairly straightforward, many many borrowers are learning that things aren’t so simple. As the federal student loan forgiveness program is just beginning to see eligibility, hardly anyone has had their loans discharged. It’s a combination of the correct type of full-time employment, 120 consecutive payments, the right kind of federal loans and be in the income-driven repayment plan.

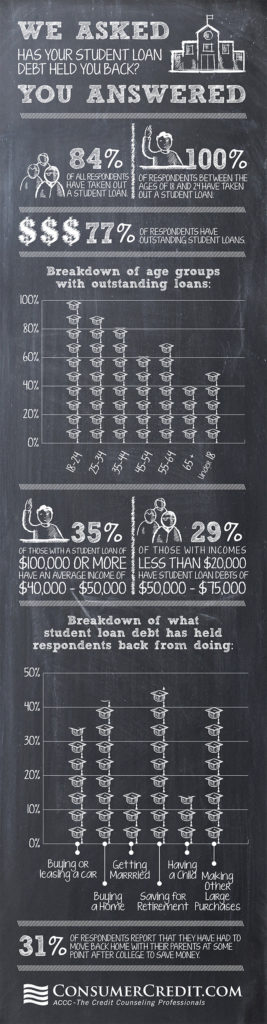

Here is our infographic on the impact of student loan debt.

Problems with the Public Service Loan Forgiveness Program

Unfortunately, information to borrowers was often wrong or difficult to follow from the onset. So a relief program was instituted to help borrowers apply for some help with their loans.

Even the relief program is difficult. According to The New York Times, “…28,207 people had submitted requests as of Sept. 28 and that it had found 21,672 ineligible almost immediately. It then culled “approximately” half of the remaining 6,535 for other reasons. That leaves just over 3,000 applications still under consideration.”

Time will tell as to whether student education loans will continue to plague borrowers hoping to have them cancelled. Stay tuned to see what happens next.

If you’re struggling to pay off debt, schedule a free credit counseling session with us today.