Paying for credit counseling may seem like adding insult to injury when trying to get out of consumer debt. However, it could be the best way to spend your money. Since the counseling can provide you with budgeting help, a debt management plan and education, the cost of credit counseling are well worth it. But how much will you be paying?

What Is the Cost of Credit Counseling?

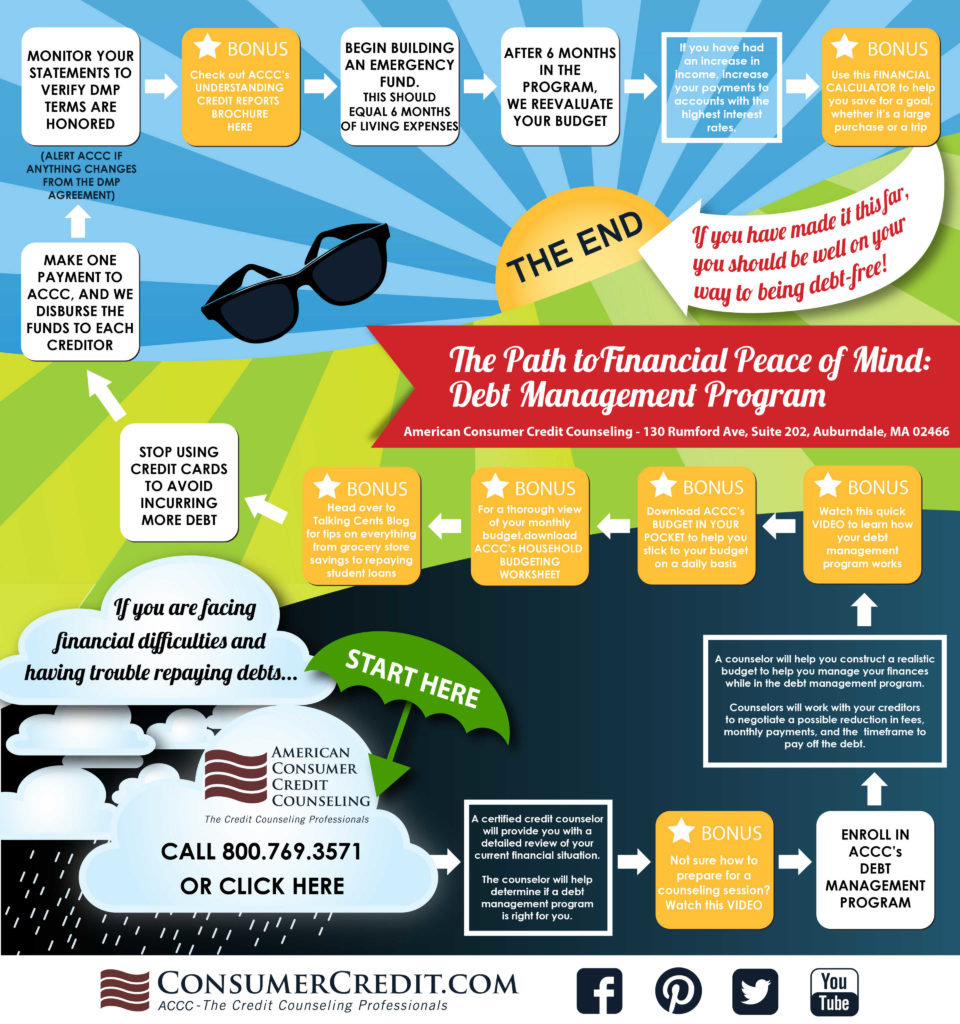

There are many factors that affect the cost of credit counseling. It’s critical to work with a reputable credit counseling agency. For a non-profit organization, like American Consumer Credit Counseling, the fees will be lower than for-profit entities.

Consumers working with ACCC receive a free budget counseling session. If the next move is to enter the debt management program, there is a one-time fee of $39. After that, there is a monthly maintenance fee of $7 per account with a minimum of $7 and a maximum of $70. The monthly maintenance fee may be waived or reduced depending on your state’s regulations or financial hardship. As a non-profit agency, the fees help to defray the cost of providing services to the many enrolled individuals. ACCC prides itself in having the lowest effective fee structure in the industry.

You may not appreciate the monthly maintenance fees within the cost of credit counseling. However, there is an even higher cost without going through it. With mounting bills, late fees and damage to your credit score looming, it would be way more costly to avoid credit counseling! Plus, ACCC can work with your creditors to try and secure 0% interest rates, lower monthly payments and the elimination of fees. It’s all part of the get out of debt plan that will be created for you.

If you are considering this service than you are probably unable to deal with your debt alone. Getting professional help is a great way to get your finances back on track and improve your financial literacy. As a result, you can better manage your day-to-day finances and your future goals.

If you’re struggling to pay off debt, ACCC can help. Schedule a free credit counseling session with us today.