If you are facing a lot of debt, you may be curious about debt consolidation options. However, there are many advantages and disadvantages to debt consolidation, and it’s not the right choice for everyone. Let’s see why debt consolidation is a bad idea for some consumers and their debts.

Reasons Why Debt Consolidation Is a Bad Idea

Depending on a few factors, debt consolidation may or may not be the right debt management plan for you. Everyone’s financial profile looks different; this includes types of debt, your financial management strengths, amounts of debt, and other needs. Here are the reasons why debt consolidation is a bad idea for certain people.

You Have Federal Student Loans that Qualify for Loan Forgiveness

Owing Federal student loans is one scenario where consolidation might be a bad choice. There are some benefits of these loans that disappear when they are consolidated. The Public Service Loan Forgiveness program is one such option that you may want to consider before changing your loans. If you intend to work full-time in the non-profit sector, teach, or some medical professions, you may qualify.

Your Credit Won’t Qualify You for Good Interest Rates

Are you considering personal debt consolidation with a private lender? If your credit score isn’t great, you won’t like the loan products they offer to you. Most likely, you will have to pay a high, variable interest rate if you consolidate privately with bad credit. Take time to bring your credit score up before springing into action.

Interest Will Jump Up Higher

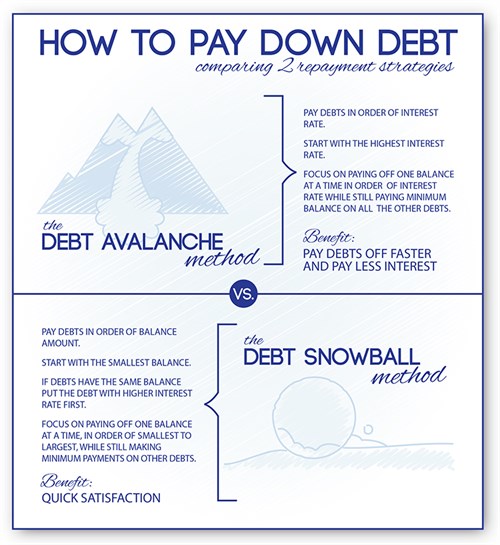

Typically, consolidation is the weighted average of your interest rates. However, tackling a high-interest loan first may make more financial sense with the Debt Avalanche method. It may be more beneficial to keep your loans separate and employ a different repayment method.

Finally, it’s best to talk through your finances with a trained financial advisor. Since everyone’s story is different, it’s important to do your own research. Remember that while debt consolidation isn’t the best choice for everyone, it can be a very helpful tool for others.

If you’re struggling to pay off debt, ACCC can help. Schedule a free credit counseling session with us today.