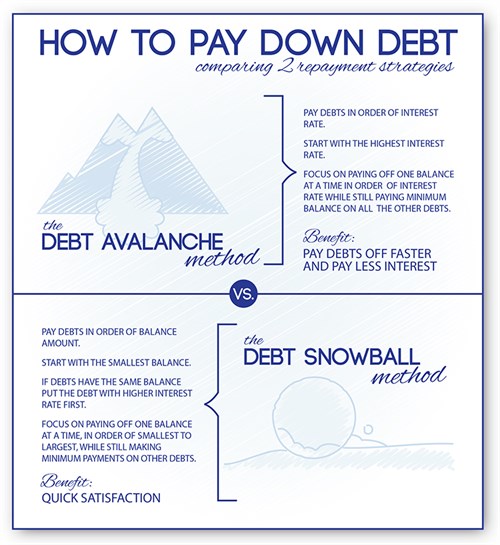

Our debt counselors say that the Debt Snowball method can be a great choice for eliminating debt. This strategy quickly knocks off smaller debts one by one. You can feel the victories as you make progress through your debt! Let’s learn how to use the Debt Snowball to get your finances back on track.

Debt Snowball How-To Guide

First, let’s imagine you are trying to make a snowman. You start with a small snowball. As you keep rolling in around in the snow, it gets bigger and bigger. This might describe the way you got into debt in the first place. However, it now describes how you will be getting out of debt!

The Debt Snowball is all about forward momentum and small victories when eliminating credit card debt and more. Starting with the smallest balance and moving up, the Debt Snowball quickly knocks off smaller debts one by one. It requires you to pay minimums on all your accounts except the one with the smallest balance. Pay this off as quickly as you can. Once it’s finished, use the money toward the next smallest debt and so forth. Taking steps like negotiating your debt can help lower the amount further to help get you started.

Debt Snowball Tools for Success

Use your budget to determine how much extra you can pay towards the target debt. Really take time to evaluate your spending and priorities. Consider gym memberships, subscriptions or other luxury categories for elimination or reduction. You can always start them again once you have eliminated the credit card debt.

Additionally, using a debt payoff calculator can be a very helpful tool. Knowing the impact of an extra $50 a month or more can be very motivating.

Let’s say you have $5,000 in credit card debt on a card with an 18% interest rate. By only making minimum payments, it will take 32 more payments or 2.7 years to pay off the remaining balance. Interest will amount to $1,314.

The Debt Snowball can help you eliminate debts so you will have a large payment available for this type of debt. The larger the payment, the quicker your debt goes away. Plus, you will owe less interest. Remember to avoid adding more consumer debt as you go through this process!

If you’re struggling to pay off debt, ACCC can help. Schedule a free credit counseling session with us today.