The fact that debt can be scary is something our debt counselors know very well. That’s why you need a solid plan in place. Here are two credit card relief options to consider: one tackles debt alone and one uses professional help.

Two Credit Card Relief Options

People find themselves in too much debt all the time. Whether you didn’t know how to properly budget or you encountered some major medical bills, there is hope to course correct and eliminate the personal credit card debt. Let’s review two credit card relief options to get back on track with your personal finances.

Credit Card Relief Option 1: Debt Avalanche & Debt Snowball

The first way to find credit card relief is to go full force at it. This may be an option if you don’t have too much debt as well as having the discipline to accomplish tough financial goals. It’s important to be honest with yourself when it comes to debt reduction. There is nothing wrong with needing financial counseling.

First, let’s walk through some of the steps you should take if you need to knock out some major debt.

- Have a complete, accurate and up-to-date list account of all your debts. This includes interest rates, balances, creditor contact info, etc…

- Prioritize the debts. Your mortgage should get paid before a credit card if you have to make a choice.

- Cut as many items from the budget as possible as well as reducing areas of expenses or spending.

- Start calling your creditors to negotiate rates and payment schedules. Keep calm but keep pushing for as much help and information as possible.

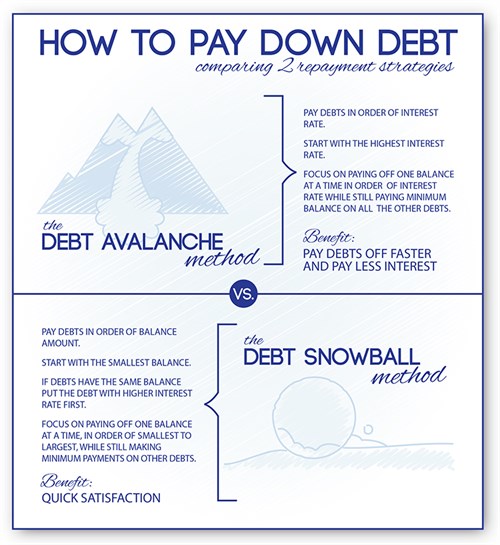

- Apply the Debt Snowball or Debt Avalanche methods to your debts.

Finally, you can use this Debt Payoff calculator to help you estimate how long it will take you to get out of debt.

Credit Card Relief Option 2: Credit Counseling Agency

The second credit card relief option is to work with a non-profit credit counseling agency. During your first conversation with a certified credit counselor, your financial situation will be evaluated. A budget will be set that you can live with while you work on a credit card reduction plan.

Depending on the details of your credit card relief situation, they may recommend a debt management program to consolidate all of your payments to creditors, enabling you to make just one payment each month. An agency, like ACCC, would then take on the task of distributing funds to your creditors directly while working with them for possible reduction in finance charges, interest rates, late fees and over-limit charges. Creditors are usually more willing to reduce or forgive charges when they know you’re actively working at reducing your debt through this type of program.

Finally, be diligent to maintain all your hard work. It’s crucial to keep to your new budgeting and spending habits once the debt is gone. You can always turn back to these tools if debt comes around again.

If you’re struggling to pay off debt, ACCC can help. Schedule a free credit counseling session with us today.