The process of debt management is a journey. How you choose to navigate through it is up to you. However, as a reputable nonprofit credit counseling agency, we at ACCC are committed to providing you with all the information to make an informed decision. The first important thing to remember is that you have options. The severity of your credit and debt problem will decide the time it takes and the path you should follow to solve the problem. The Debt Snowball method can be a great choice when trying to eliminate debt. This post is dedicated to going through the ins and outs of the debt snowball method.

Debt Snowball Method Explained:

This strategy focuses on knocking off smaller debts one by one quickly. The main benefit of following through with this approach is that there is evident progress on repaying your debt. This approach navigates you through your debt journey carefully and methodically. Eventually, this process can help your finances get back on track!

So, why is this approach called snowball? It is as literal as it gets. s you keep rolling a snowball it gets bigger and bigger. This same principle is applied to your debt. This is essentially how you get deeper in debt but also the approach to getting out of it! That’s the beauty of it!

A Guide to Debt Snowball Method:

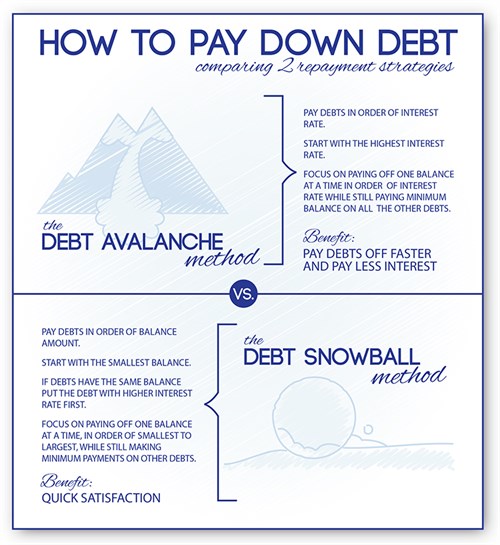

The Debt Snowball is all about forward momentum and small victories when eliminating credit card debt and more. This method urges you to start with the smallest debt and move up. It encourages you to get rid of the smaller debt balances quickly. This does not mean you are ignoring the other debts on your file. While you are working to pay off the smaller balances you are also paying the minimums on all other debt accounts. As with any other debt payment option, the first step is to list out all your debts from the smallest to the largest, so that you are approaching your debt more methodically. Pay this off as quickly as you can. Once it’s finished, use the money toward the next smallest debt and so forth. You can also talk with a professional at a reputable nonprofit credit counseling agency to seek advice and any possible negotiations that may come in handy. The following infographic can give you a quick snapshot to the most popular approaches to debt payoff side by side. This can help you understand what approach suits you best!

Financial Tools That can Help Your Debt Snowball Journey

Your budget is the foundation to all your money matters. Your budget is a good place to find solutions to your debt issues. Once you have a detailed working budget, it is easy for you to determine the amount of money you can allocate for your debt. If you see you don’t have a substantial amount to put towards your debt, then this is where you should sit down and really evaluate. Look at each and every item in your budget. You need to make tough calls to cut back on the spending and allocate more money towards your debt. Subscriptions, cable, Phone plans are some places you can start considering. Getting your spending priorities in order I the first step to course-correcting your debts.

Once you have that in order, look at using a debt payoff calculator. This can be a very helpful tool to organize your debt and approach it methodically. The one important thing to remember in this journey is to avoid adding more consumer debt as you go through this process!

Why Debt Snowball?

The debt snowball method of paying off debt is a fast track method. Just as a snowball gains momentum when rolling downhill, this method picks up the pace the more you pay off your dues. As explained earlier how would you approach this method? Simple. Any debt off strategy begins by recognizing the debt you have. Therefore, the first thing you need to do is make a list. Make sure you include every big and small debt in this list. Organize them from the smallest to the largest.

Next, reallocate your budgets and ensure you have enough funds to make all the minimum payments on your debts. This is crucial. While you are focusing on paying off the smaller debts you must ensure that you are not accumulating interest and fees on the remaining ones.

When you do allocate your money, make sure you allocate a larger portion of it to the smaller debts. The point of following the snowball method is to pay above the minimum on your smaller debts. This way you are tackling the smaller debts quicker and you move on gradually to tackling the larger debts.

Once you have cleared your smaller debts, allocate that money to your next debt in line. The money you allocate for debts from your budget should always remain there until you finish tackling all of your debts. This way you are given the chance to add more money towards your bigger debts as you move down the list.

The last step to making any debt pay off strategy a success is a commitment you have to get through the process. Financial discipline is crucial in the process. Reviewing your budget from time to time to see how you are doing and keeping track will get you through this debt journey.

Why Does it work?

The debt snowball method to pay off debt is focused on getting you in a habit. Managing debt has a lot to do with your responsible financial behavior. Following this approach modifies your behavior thus yielding positive results.

The second reason this approach has proven success is visible results and progression. If you start with a larger debt you will take longer to see any dent in the process. This can easily demotivate you and distract you from the process. On the other hand, if you tackle your smaller debts first you tick off your items of the list much sooner. This is a motivation for you to keep going and be committed to the process.

Thirdly, because you have eliminated a number of smaller debts on your accounts, you have also freed up a considerable amount of cash to pay off your larger debts. This makes your larger debt pay off faster too. The momentum you build with this approach is an inbuilt motivator to keep going.

Does this Approach Suit You?

Making an informed decision as to what debt strategy to use is up to you. You will compare your debt pay off options such as the debt avalanche method and debt snowball to your particular debts. In this process, you can speak with qualified credit counselors to get some advice. They will have a professional outlook and help you get to your target sooner.

You must choose the method that fits based on your disposable income. Just because one approach may look superior to the other on paper it may not suit your needs. It is better you choose a plan that works rather than one you abandoned along the way. Making an objective choice is crucial. Considering your overall financial situation and your financial capability you can make an informed decision as to which debt pay-off method to follow.

If you are struggling to pay off debt, ACCC can help. Check out our debt management program today!