Debt can take over your finances, but it also inserts itself into nearly every area of your life. From the groceries you buy to the bills you are able to pay, debt will dictate those decisions and more. Paying down debt is a fantastic goal. You need a plan to achieve this goal. Learn the differences between the Debt Snowball vs Debt Avalanche to see which strategy best fits your needs.

Choosing a Strategy: Debt Snowball vs Debt Avalanche

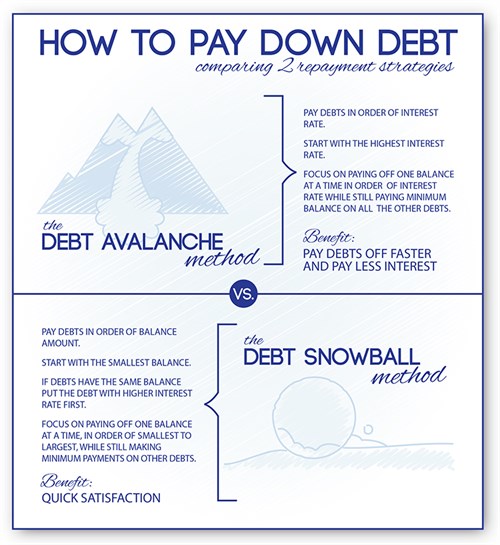

If you aren’t in serious trouble with collections or past due accounts, one of these debt elimination strategies should be a good option for you. It’s important to take a clear path with debt management. Let’s take a look at the Debt Snowball vs Debt Avalanche methods in this helpful financial infographic.

Debt Snowball

The Debt Snowball is all about forward momentum and small victories when eliminating credit card debt and more. Starting with the smallest balance and moving up, the Debt Snowball quickly knocks off smaller debts one by one. It requires you to pay minimums on all your accounts except the one with the smallest balance. Pay this off as quickly as you can. Once it’s finished, use the money toward the next smallest debt and so forth. Use your budget to determine how much extra you can pay towards the target debt. Taking steps like negotiating your debt can help lower the amount further to help get you started.

Debt Avalanche

Instead of eliminating your smallest debts first, the Debt Avalanche targets debts with the highest interest rates and works its way down. It prioritizes the debt with the highest interest rate while doing minimum payments on everything else. This method will save you more money than the Debt Snowball, but it might not be as motivating since debts don’t get cleared as fast.

If fiscal discipline isn’t your strong suit and your interest rates aren’t insane, you may lean towards the Debt Snowball. However, if you have high-interest rates, the Debt Avalanche is probably the best bet to achieve your goals and save the most money.

If you’re struggling to pay off debt, ACCC can help. Schedule a free credit counseling session with us today.